Private equity investment in Africa drops significantly

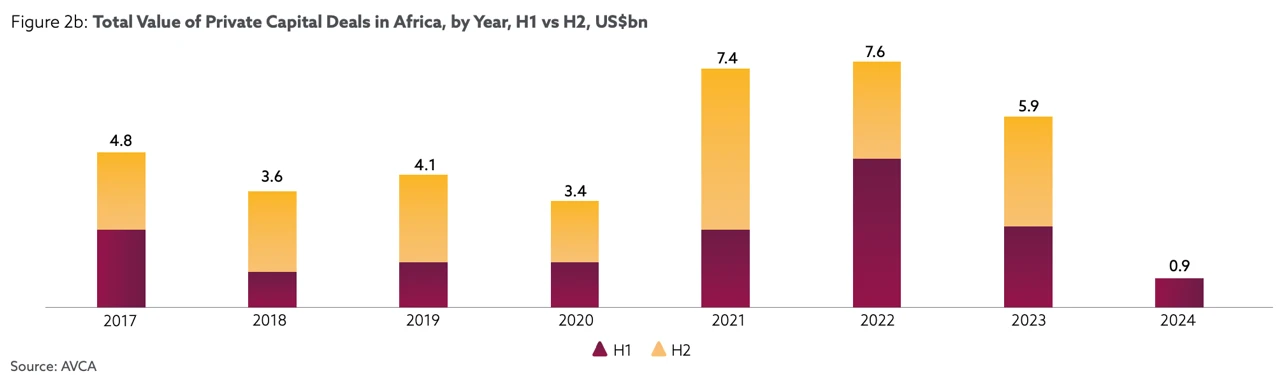

Local and international private equity players invested $900 million in African companies during the first half of 2024, the African Private Equity and Venture Capital Association (AVCA) reported.

This amount marks a 66 percent decrease compared to the same period in 2023. However, West Africa saw a 3 percent increase in investments.

From January 1 to June 30, 2024, there were 182 transactions across the continent, representing a 17 percent decline from the previous year.

The "Q2 2024 Private Capital in Africa Report" attributes the decline in both value and volume of transactions to ongoing macroeconomic uncertainties.

These include persistent restrictive monetary policies, high inflation, and geopolitical tensions, which have led many industry players to adopt a more cautious approach and make smaller investments.

“In the first half of 2024, African economies braved through yet another challenging macroeconomic environment, a global trend that has been persistent in recent years,” the report notes.

In this context, the African private capital industry recorded 182 deals with a cumulative value of US$0.9bn, representing a 17 percent YoY decline in volume and a 66 percent YoY decline in value.

While deal volumes kept the pace at 83 percent of H1 2023 levels, the value of these deals fell short of the levels reported in H1 2023. Q1 2024 kicked off to a slow start, recording US$0.5bn in deal values, which declined further by 27 percent in Q2 2024.

Notably, transactions over $100 million fell by 91 percent year-on-year in the first half of 2024. Conversely, transactions under $50 million accounted for 88 percent of the total investment value. Consequently, the average transaction size decreased from $20 million in 2023 to just $8 million in the first half of 2024.

In terms of regional investment distribution, West and East Africa together received 60 percent of the transaction value, with each region accounting for 30 percent. Southern Africa followed with 10 percent, North Africa with 9 percent, and Central Africa with just 1 percent.

Additionally, 20 percent of investments were made in companies operating in Africa but based in other regions of the world.

The sectoral breakdown shows that the financial services sector captured 39 percent of the total transaction value, followed by the industrial sector (12 percent), consumer staples (10 percent), information technology (10 percent), communications services (7 percent), and utilities (6 percent).

The report also notes that Africa-focused fund managers raised a total of $1.3 billion in the first half of 2024. This amount includes $1 billion from final closes and $300 million from interim closes. This period proved particularly challenging for new fund managers entering the African market, with none achieving a final close.

In addition, private equity firms in Africa executed 22 exits in the first half of 2024, compared to 17 exits during the same period last year.

In a cooling market, fund managers have relied on established exit strategies. The most common exit route remains sales to trade buyers, followed by asset sales to other private equity firms, management buy-outs, and initial public offerings (IPOs).

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED