Tanzania’s rapid public debt growth raising fiscal sustainability concerns

Tanzania’s national debt has surged at nearly twice the pace of its economic growth over the past five years, prompting questions about long-term fiscal sustainability despite robust revenue mobilization.

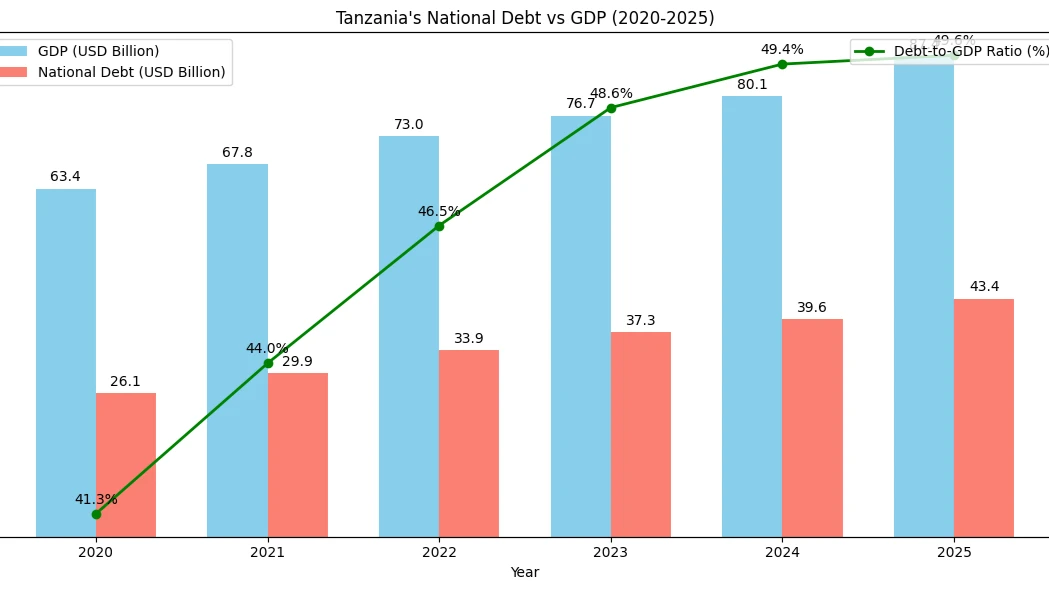

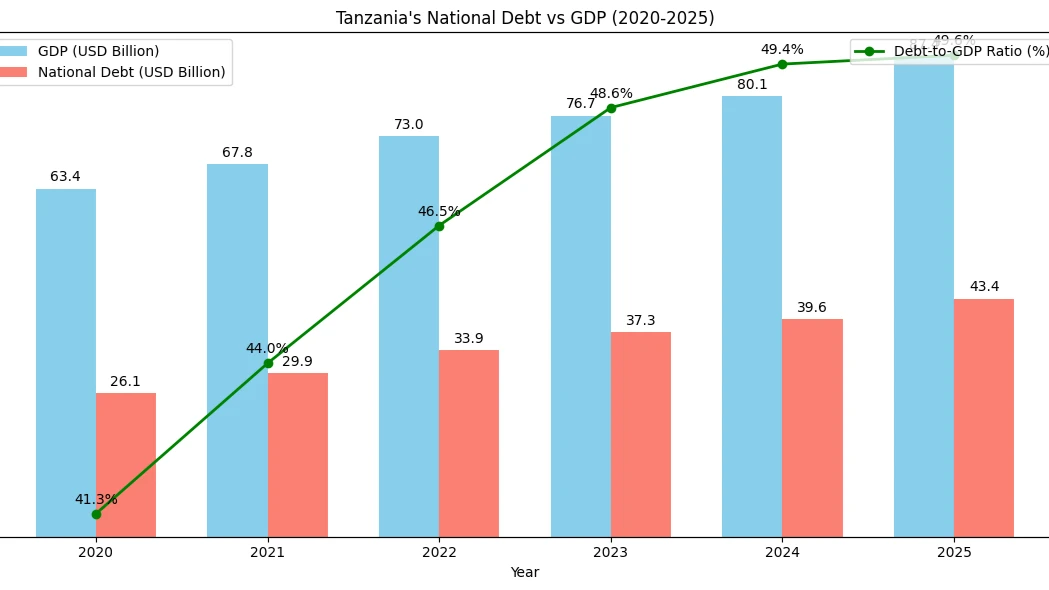

A recent comprehensive analysis by the TICGL Economic Research team highlights that from 2020 to 2025, the country’s debt increased by 65.8 percent to an estimated USD 48.35 billion, while gross domestic product (GDP) grew by only 38 percent, pushing the debt-to-GDP ratio to 49.6 percent.

The findings reveal that Tanzania is edging closer to the International Monetary Fund’s (IMF) 55 percent danger threshold for developing economies.

During the period, the gap between debt growth and GDP growth ranged from 3.8 to 7 percentage points annually, although preliminary projections suggest a modest improvement in 2025, when GDP growth (9.1 percent) slightly outpaced debt growth (8.5 percent).

Analysts warn, however, that this marginal improvement is highly contingent on sustained economic performance.

The debt stock has expanded both domestically and externally, with external obligations comprising 73.4 percent of total debt by the end of 2025. External debt denominated in US dollars accounts for nearly 68 percent of obligations, exposing the country to significant foreign exchange risk.

Historical depreciation of the Tanzanian shilling against the dollar has already increased the local currency cost of servicing USD-denominated debt by more than 11.5trn/- (approximately USD 4.34 billion) between 2020 and 2025.

Stress tests indicate that a severe 20 percent depreciation of the shilling could push Tanzania’s debt-to-GDP ratio to nearly 60 percent, surpassing the IMF threshold and triggering high fiscal distress risk.

The surge in borrowing has been concentrated in infrastructure and government support. Between 2020 and 2025, infrastructure projects such as roads, railways, and ports absorbed 52 percent of new debt, while budget support accounted for 21.8 percent. Only 17 percent of borrowing targeted clearly productive sectors such as energy, agriculture, and ICT.

The Standard Gauge Railway (SGR) project alone has consumed over USD 11 billion but is generating only half of the projected revenue, creating an annual fiscal gap of USD 390 million.

Other projects, including the Julius Nyerere Hydropower Plant and the National Fiber Optic Backbone, have exceeded revenue targets, highlighting a mixed performance across the portfolio.

Tanzania’s shift from concessional loans toward commercial borrowing is another point of concern. While 68 percent of external debt remains concessional, the 32 percent commercial debt share carries average interest rates of 6.8 percent, nearly four times higher than concessional alternatives.

This transition has increased annual debt service costs by USD 500-600 million and represents a significant erosion of fiscal flexibility. Analysts caution that if the country continues to rely on high-cost commercial borrowing, debt sustainability could deteriorate rapidly.

Despite these challenges, the Tanzanian government has achieved remarkable revenue mobilization. Tax revenue as a share of GDP increased from 11.1 percent in 2020 to 21.2 percent in 2025, contributing to total government revenue growth of 246.7 percent. This strong fiscal performance has helped keep debt service as a percentage of government revenue at 14.5 percent in 2025, below the 18 percent IMF danger threshold, after exceeding it in 2023 and 2024.

Regional comparisons provide additional context. Tanzania’s debt-to-GDP ratio of 49.6 percent is below the East African Community (EAC) average of 61.5 percent and the Sub-Saharan Africa average of 58.9 percent.

However, its debt accumulation rate—the fastest in the region alongside Rwanda between 2021 and 2025—signals potential convergence with higher-risk peers like Kenya and Ethiopia within the next few years if borrowing trends continue.

Under President Samia Suluhu Hassan, annual debt accumulation accelerated to USD 6.25 billion, nearly three times the rate observed during President Magufuli’s tenure.

Economic growth has been unevenly debt-dependent. Sectors such as transport and construction, which benefit most from debt-financed projects, show robust growth but have long return-on-investment timelines of 15-25 years.

Meanwhile, services contribute over 40 percent of GDP growth with minimal debt reliance, underscoring that a significant portion of debt-funded expansion is front-loaded in obligations but delayed in revenue generation.

Approximately 40 percent of GDP growth between 2020 and 2025 has been financed through public spending and investment, heightening the economy’s reliance on continued borrowing.

TICGL’s analysis concludes that while Tanzania remains solvent in the medium term, liquidity pressures and the rising debt service burden—especially on USD-denominated commercial debt—pose substantial fiscal risks. Experts recommend cautious borrowing strategies focused on concessional financing, accelerated project revenue realization, and careful management of currency exposure to prevent a debt crisis.

As Tanzania navigates a path toward continued infrastructure development and economic expansion, policymakers face the delicate challenge of balancing immediate growth needs with long-term fiscal sustainability, ensuring that borrowing today does not compromise economic stability tomorrow.

However, the Bank of Tanzania’s debt reviews suggest that while Tanzania’s public debt situation in 2025 remains within internationally accepted sustainability benchmarks, risks are rising and must be managed with concerted fiscal strategy.

Top Headlines

© 2026 IPPMEDIA.COM. ALL RIGHTS RESERVED