Leasing finance. A catalyst for agricultural, economic transformation in Africa

Africa’s development debate has long revolved around finance — who has it, who does not, and how much is needed. But perhaps we have been asking the wrong question. The real constraint in many of our economies is not demand for productivity-enhancing tools. It is access to them.

Africa does not lack demand for equipment. Africa lacks access to equipment.

Across the continent, leasing penetration averages between 0.5 and 2 percent of GDP, compared to more than 5 percent in advanced markets. At the same time, agriculture — which employs more than half of the workforce in many African countries — receives less than 5 percent of formal bank credit. Yet this is the sector that feeds our people, employs our youth, and anchors rural livelihoods.

The productivity gap is stark. Africa averages roughly two tractors per 1,000 hectares of arable land. In parts of Asia, the number exceeds 100. That gap is not merely statistical. It represents lost output, persistent post-harvest losses, rural drudgery, low incomes, and unrealised economic transformation.

Leasing offers a practical and scalable solution to this challenge.

Unlike traditional lending, leasing shifts the fundamental question from “Who can afford to buy?” to “Who can productively use?” That distinction is transformative, especially in agriculture. A tractor costing USD 40,000 may be well beyond the reach of an individual farmer. But structured leasing — aligned to seasonal cash flows — enables access without imposing prohibitive upfront capital requirements.

This model recognises a simple economic truth: productivity generates repayment. Collateral alone does not.

Encouragingly, several African countries are demonstrating what is possible. Kenya and South Africa have strengthened legal and regulatory frameworks to support asset-based finance. Nigeria and Morocco have advanced mechanisation initiatives that incorporate structured finance models. Across the continent, vendor partnerships and leasing-backed mechanisation service providers are emerging as viable rural enterprises.

Yet structural constraints persist.

Many leasing companies remain undercapitalised. Shallow capital bases translate into short tenors, high pricing, and limited risk appetite. Agriculture, by its nature, is seasonal and weather-sensitive. It requires patient capital and financing structures of five to seven years for equipment. Without adequate capitalisation, leasing institutions struggle to meet these realities.

Currency mismatches further complicate the landscape. Most agricultural equipment is imported in foreign currency, while revenues are earned in local currencies that are often volatile. In addition, secondary markets for used equipment remain underdeveloped, increasing residual value risk and limiting balance sheet flexibility.

These are not merely technical financial challenges. They are development challenges.

Well-capitalised leasing institutions can lower the cost of funds and pass these benefits to clients. They can offer longer tenors aligned with agricultural cycles and structure grace periods tied to harvest seasons. They can invest in refurbishment capacity and support the development of secondary markets. Most importantly, they can scale fleet-based mechanisation service models that multiply impact.

In agriculture, leasing allows us to move beyond fragmented ownership towards shared access. Instead of one farmer struggling to acquire a tractor, we can enable youth-led mechanisation enterprises that serve clusters of smallholders. Such models increase asset utilisation, generate rural employment, and accelerate productivity gains without placing additional pressure on public debt.

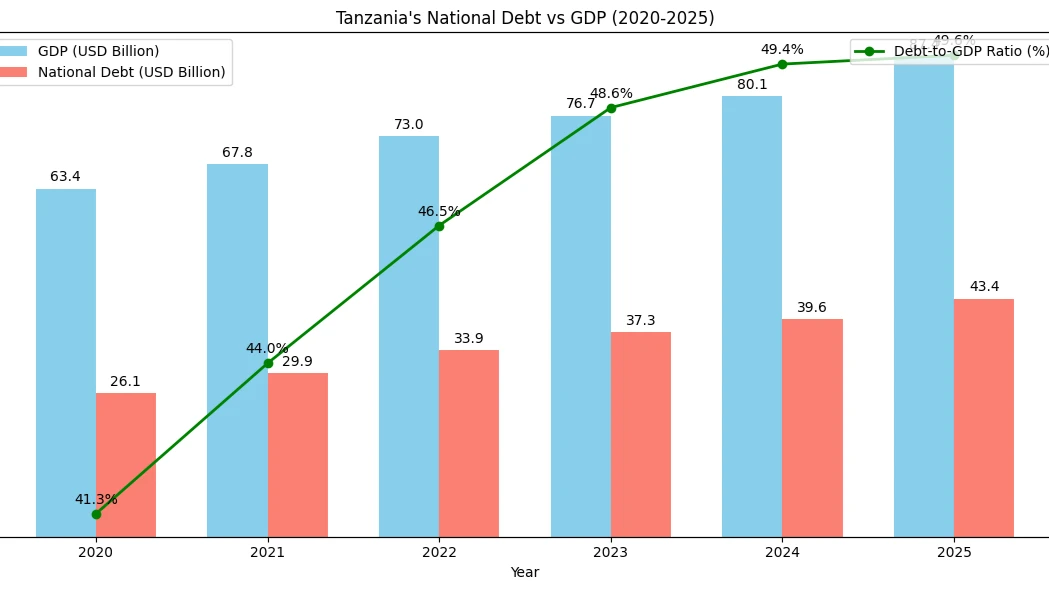

In East Africa — and particularly in Tanzania — the case for leasing as a strategic instrument is compelling. The region’s population is young and growing rapidly. Urbanisation is accelerating. Food demand is rising. Yet agricultural productivity remains below potential. In Tanzania, mechanisation levels average only two to three tractors per 1,000 hectares. Post-harvest losses in some value chains range between 15 and 40 percent.

Traditional bank lending often requires land titles or fixed collateral that many rural enterprises do not possess. Leasing, by contrast, relies on the asset itself as security. It aligns repayment with productive use and recognises the realities of agricultural cash flows.

Moreover, leasing extends beyond agriculture. It supports small and medium enterprises in transport, construction, agro-processing, renewable energy, and logistics. It strengthens value chains and deepens financial markets. It shifts financing away from consumption and towards productive asset formation.

In this sense, leasing is more than a financial instrument. It is industrial policy. It is productivity policy. It is youth employment policy. And increasingly, it is climate adaptation policy, as modern equipment enhances efficiency, reduces losses, and improves resilience in the face of changing weather patterns.

If Africa is serious about structural transformation, we must move decisively from financing working capital alone to financing productive assets. We must capitalise, structure, and scale leasing institutions so they can meet the continent’s vast and evident demand.

The question before us is not whether demand exists. It clearly does. The question is whether we will build the institutional capacity to respond to it.

If we do, we will not merely finance equipment.

Prof. Andrew Temu (pictured) is a distinguished agricultural economist from Sokoine University of Agriculture (SUA) in Tanzania and former Chair of the Private Agricultural Sector Support (PASS) Trust.

Top Headlines

© 2026 IPPMEDIA.COM. ALL RIGHTS RESERVED