Tanzania’s economy sets to navigate toward 7pc growth amid global shifts

Tanzania projects to enter a transformative economic phase, characterised by a transition from steady recovery to accelerated growth.

According to the Bank of Tanzania’s (BoT) Monetary Policy Statement Mid-Year Review for 2025/26, released on Saturday, the nation is successfully leveraging a "less restrictive" monetary policy to catalyze domestic production while maintaining one of the most stable inflation environments in the East African region.

With the Central Bank Rate (CBR) held at 5.75 percent as of January 2026, the policy focus has shifted toward ensuring that liquidity remains adequate to meet the rising demands of a diversifying economy.

“This strategic shift reflects a central bank that is confident in its domestic stability and is now prioritizing the fueling of credit to the private sector to sustain long-term developmental goals,” comments financial analyst.

The domestic outlook for the remainder of the 2025/26 fiscal year and into the 2026 calendar year is overwhelmingly positive, suggesting that the structural reforms and infrastructure investments of recent years are beginning to yield substantial dividends.

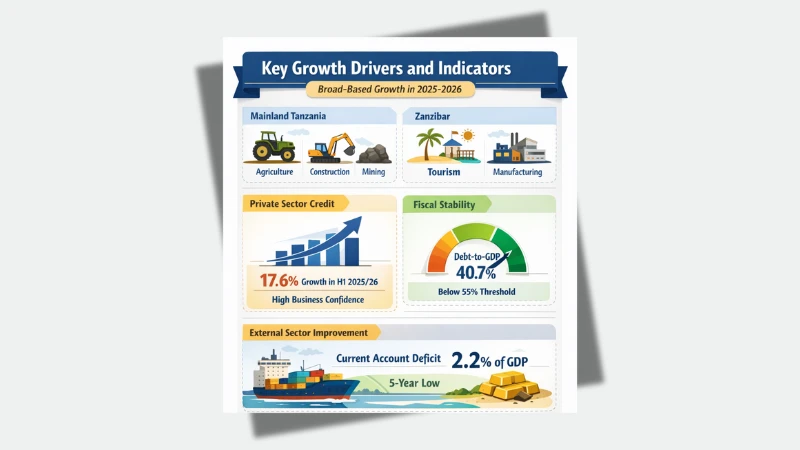

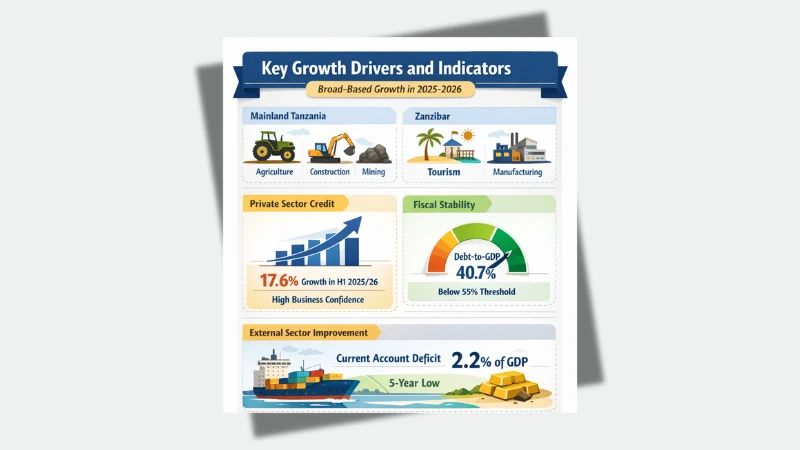

According to BoT, in Mainland Tanzania, GDP growth in the second half of the fiscal year is projected to accelerate to more than 6 percent.

This momentum is expected to be broad-based, with the primary engines of growth being agriculture, mining, and construction.

Zanzibar's economic prospects are even more ambitious, with a projected growth rate of 7.2 percent for 2026, largely attributed to a thriving tourism sector, increased manufacturing activities, and significant ongoing construction projects.

Latest data show in 2025, Zanzibar recorded a record 917,167 international tourist arrivals — the highest in its history — up nearly 25 percent from 2024.

Authorities and industry players are optimistic that strong tourism momentum seen in late 2025 will continue into 2026, with sustained growth expected thanks to improved air connectivity, marketing efforts, and global travel demand.

The IMF projects Tanzania’s real GDP growth at about 6.3 percent in 2026, up from around 6.0 percent in 2025 — reflecting continued expansion supported by investment, policy reforms, and resilient domestic demand.

BoT notes that business confidence remains high, as evidenced by recent surveys of CEOs and market perceptions conducted in December 2025, which indicate a widespread expectation of continued economic expansion and increased capital expenditure by the private sector.

A critical pillar of this outlook is the projected stability of inflation, which the BoT forecasts will remain firmly within the medium-term target range of 3–5 percent.

This stability is underpinned by several factors, including adequate domestic food supplies that are expected to keep price pressures low despite seasonal fluctuations.

Additionally, the Tanzanian Shilling has demonstrated remarkable strength, recording an appreciation of approximately 5.5 percent against the US Dollar during the first half of the fiscal year.

This currency stability is a cornerstone of the BoT's strategy, as it reduces the cost of essential imports such as machinery and industrial raw materials.

Continued market interventions by the BoT will ensure the Shilling remains stable, helping to absorb external shocks and support efficient market functioning while maintaining the purchasing power of Tanzanian citizens.

According to BoT, Tanzania’s external sector is also poised to benefit significantly from shifting global market dynamics, which are increasingly favorable to the nation’s export profile.

While global growth is projected at a modest 3.3 percent for 2026, specific commodity trends are aligning in Tanzania's favor.

Gold prices are projected to rise further, potentially reaching above USD 5,000 per troy ounce due to sustained safe-haven demand amidst global geopolitical uncertainty.

As a major gold producer, this trend will bolster Tanzania's export earnings and continue to narrow the current account deficit, which reached a five-year low of 2.2 percent of GDP in 2025.

Conversely, global oil prices are expected to fluctuate narrowly between USD 62 and USD 65 per barrel, according to IMF outlook.

This moderation will significantly reduce the national import bill and mitigate the risk of imported inflation, providing the government with more fiscal space to fund social services and infrastructure.

The central bank report shows banking sector is currently described as sound, liquid, and increasingly efficient, serving as a robust intermediary for the country's growth ambitions.

A major highlight is the significant improvement in asset quality, with the ratio of non-performing loans (NPLs) falling to 2.8 percent at the end of December 2025, which is well below the 5 percent regulatory ceiling.

This healthy financial environment is expected to further incentivize lending to the private sector, which grew by 17.6 percent in the first half of 2025/26.

Furthermore, the BoT is aggressively pursuing a "cash-lite" economy, with the value of mobile payment transactions increasing by 16.5 percent, reflecting deeper financial inclusion and a conducive payment system environment that allows for more transparent and efficient economic activity.

The Monetary Policy Committee is scheduled to meet in April 2026 to set the CBR for the final quarter of the current fiscal year.

The current stance remains less restrictive, with the BoT prepared to intervene in the foreign exchange market to smooth volatility and build reserves, which currently stand at a robust US$6.3 billion, represents nearly five months of import cover, providing a formidable cushion against any unforeseen external disruptions.

By balancing price stability with growth-oriented policies and ensuring compliance with regulatory frameworks, the BoT is positioning the country as a resilient, high-performing economy on the continental stage, ready to navigate the complexities of the global financial landscape while delivering tangible domestic prosperity.

Top Headlines

© 2026 IPPMEDIA.COM. ALL RIGHTS RESERVED