Zanzibar issues sharia compliant bond to finance infrastructures

The government of Zanzibar has issued the sharia compliant bond arrangement, to raise funds for financing key government projects.

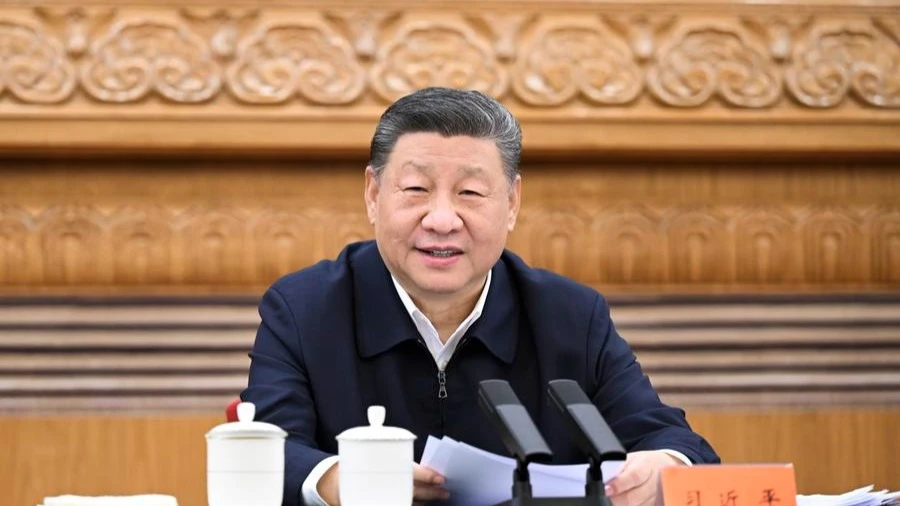

Speaking at the Sukuk Bond Board last week, the Minister of State in the President’s Office (Finance and Planning)Dr Saada Mkuya (pictured) said the introduction of the bond would provide a broader platform for the government to secure funding for key infrastructure projects.

“The funds raised through this bond will be invested in projects that comply with Sharia principles, ensuring accountability and transparency in financial management,” Dr Mkuya said.

The minister stated that People’s Bank of Zanzibar will be the official collecting bank for the Sukuk investment initiative, launched under the Treasury of the Revolutionary Government of Zanzibar.

“The Revolutionary Government of Zanzibar is leveraging the Sukuk bond to mobilise funds for development projects on the island. The initiative aims to expand financing options beyond traditional loans,” Dr Mkuya noted.

Sukuk distribute periodic coupon payments from the profit generated in the pool of assets or business activity. At the end of this Sukuk period, known as maturity date, issuers pay back the money raised from investors, known as the principal.

This initiative offers an exciting and secure opportunity for individuals and institutions to invest in government-backed projects while adhering to Sharia principles.

“By investing in Sukuk through People’s Bank of Zanzibar, customers contribute to the development of key government projects, fostering economic growth and financial inclusion. Investors can expect competitive returns on their funds while supporting strategic national initiatives in infrastructure, energy, and social development,” she said.

The minister further said Sukuk bond offers an attractive return rate of 10.5 percent per annum, positioning it as one of the most rewarding investment avenues in the market.

PBZ Managing Director, Arafat Haji, said the bank is committed to ensuring a seamless, transparent and customer-friendly investment process.

He said investors could participate in Sukuk through the bank’s branches and digital platforms, ensuring accessibility from anywhere.

“The bank’s dedicated Islamic banking division, PBZ Ikhlas, offers professional advisory services to guide customers through the investment process. We also guarantee a straightforward and efficient investment process, ensuring timely collection and allocation of funds while upholding the highest standards of compliance with Islamic banking principles,” he said.

Haji said that the bank takes pride in being a trusted financial partner in Zanzibar’s economic growth, providing customers with an unparalleled opportunity to earn lucrative returns while contributing to national development.

“We invite all customers to take advantage of this opportunity and become part of Zanzibar’s economic transformation,” he added.

S&P Global Ratings forecasts that Sukuk issuance will amount to US$190 billion to $200 billion in 2025, following the market's strong performance last year. Total issuance reached US$193.4 billion in 2024, down slightly from the previous year's US$197.8 billion.

Fitch Ratings, another global rating agency also expects outstanding global Sukuk to cross US$1 trillion in 2025, remaining a key part of the debt capital market (DCM), with strong growth in emerging markets.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED