How inflation works in relation to consumer price-hike frustrations

The Bank of Tanzania (BoT) has clarified that inflation measures the price increase for 383 products used at the household level, including petroleum products, which directly affect the prices of other products in the market.

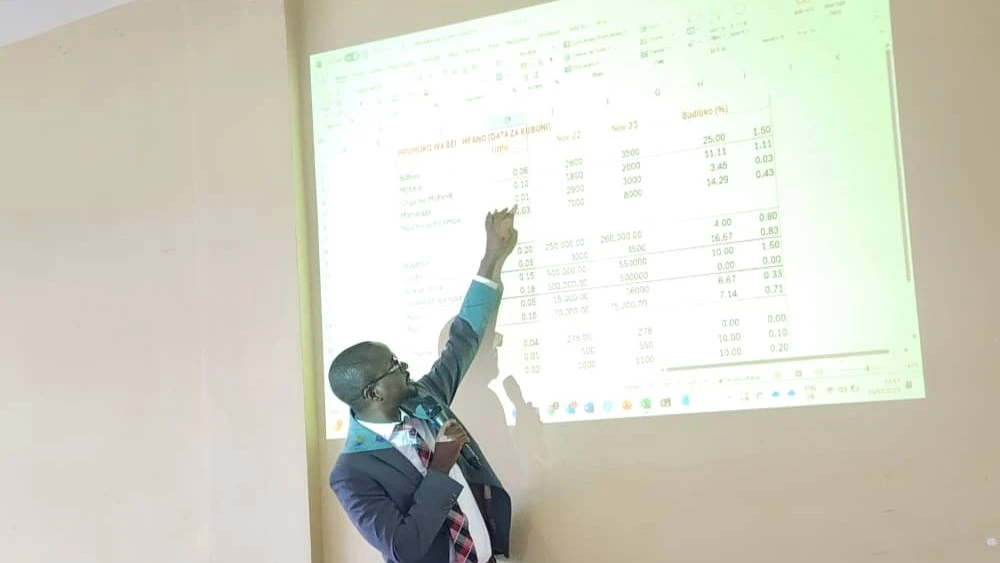

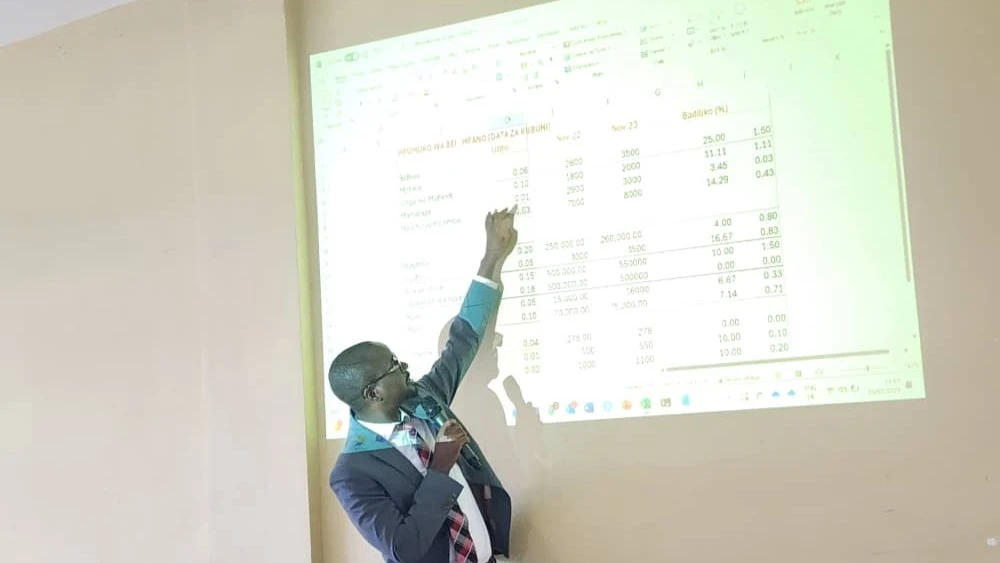

Speaking during the presentation of the topic on interest rate-based monetary policy 2024 today in Mtwara in a seminar for journalists, the Policy and Economic Officer in the Directorate of Economic Research and Policies, Dominic Mwita, explained that the depreciation in inflation does not mean a decrease in the price of goods, but it indicates that the rate of price increase is moderate.

"If the inflation rate for January is 3.1 percent, it means that on average, the prices of the products mostly consumed have appreciated by that percentage.

If it was four percent and dropped to 3, it does not mean that the prices of products have decreased, but they have increased at a slower pace," said Mwita.

He said inflation is calculated by comparing price changes between two different periods, often within a month or a year, by collecting the prices of various products every month.

He explained that the evaluation is done based on the basic needs of the family, while inflation is largely related to the production of goods and the state of the economy in general.

In further clarification, Mwita said some products are closely measured to determine price trends, such as food, energy, and social services.

He said such services include rent, transportation, school fees, home repairs, clothing, and health. The product's contribution to inflation depends on the level of household consumption in the relevant product.

However, some products have a small share of household consumption but are increasing at a high rate, so their impact on inflation is small.

Concerning inflation management, Mwita has noted that there are factors that can affect prices that are beyond the control of the central bank, such as drought or crop pests.

In such cases, the government uses policy measures, such as subsidies on essential commodities like fuel, to control inflation.

"Inflation occurs when there is more money in circulation than the real demand of the economy. The government does not make decisions to print money arbitrarily because a lot of money in circulation leads to an increase in product prices and a decrease in the value of money," said Mwita.

According to him, the rate of inflation in Tanzania is less than 5 percent, while regional parameters show that SADC countries should have inflation between 3 to 7 percent, while EAC countries should have a rate of 8 percent.

Mwita said that Tanzania's economic growth depends on the good management of various policies, including financial policy, budgetary policy, and sector policies such as agriculture, trade, and industry.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED