MPs approve bill to amend social security contributions

THE National Assembly has passed the Social Security (Amendment) Bill, 2024, which among other things reduces penalties for late contributions and allows employees with different employers to receive contributions from all their employers with consent.

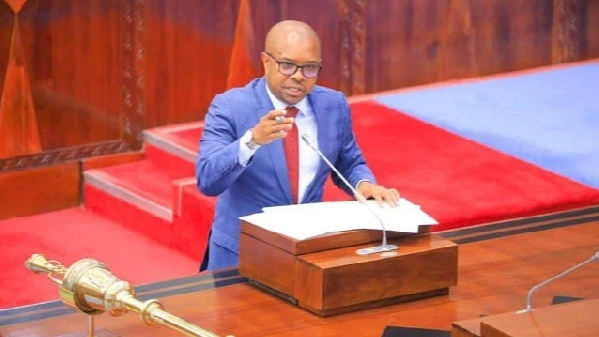

Ridhiwani Kikwete, the Labour, Youth, Employment and Disabled Persons state minister in the Prime Minister's Office (PMO) presented the bill in the House, saying that amended law permits members who have not yet reached retirement age to use part of their benefits as collateral for a housing loan.

It also allows for contributions made by a member after retirement up to the age of 70, to be taken up in pension calculations.

He told MPs that amendments affect the National Social Security Fund Act, Cap. 50, the Public Service Social Security Fund Act, Cap. 371, and the Workers Compensation Act, Cap. 263.

A new section, 11A, has been introduced to extend social security coverage to self-employed individuals, with provisions allowing employers to make substantial or total contributions for employees.

Section 12(5) is proposed for amendment to clarify the contribution process for self-employed members, while Section 12A has been added to allow employees with multiple employers to receive contributions from all their employers with their consent.

“The aim of these amendments is to provide members with the flexibility to receive contributions from more than one employer,” he explained, elaborating that Section 14(3) has been amended to reduce the penalty for late contributions from five percent to 2.5 percent.

“This change aims to establish a fair penalty amount, lower operational costs for employers and provide a more manageable fine,” he specified

The bill also authorises the board to remove excess contributions with the approval of the minister in charge of social security, easing the burden on institutions that struggle to pay fines due to financial constraints, he said.

New offenses have been introduced for employers who refuse to register or obstruct inspectors during their duties, with Section 15 mandating the director general of a fund to ensure that the total amount is placed into the social security fund.

This will be the case even if it was deducted by an employer and not submitted to the fund, to protect the interests of beneficiaries, he said, insisting that the new amendments seek to improve the management of erroneously received contributions.

They also broaden pension benefits availability for members who have reached retirement age but do not meet the criteria for pension eligibility and have been contributing from ages 61 to 70, he stated.

The bill also introduces a mandatory obligation for employees of companies where the government owns at least 30 percent of shares to be registered with the Public Service Social Security Fund (PSSSF), he stated.

It improves requirements related to recording contributions for employees, allowing members to obtain their contribution history from the relevant fund.

“Section 24 has been repealed to remove the provision allowing a member to withdraw their contribution from the Social Security Fund and cease membership, as this conflicted with social security regulations and was more suited to the savings fund,” he stated.

New provisions stipulate that beneficiaries serving prison sentences may authorise in writing that their benefits, or any part of them, be paid to a designated beneficiary.

“The aim of these amendments is to enhance the participation of individuals serving prison sentences in the distribution of their benefits,” the minister noted.

The bill amends the Workers Compensation Act by empowering the board to amend or remove any conditions related to benefit payments under the Act when valid reasons arise.

“Section 39 is proposed for amendment to allow the application of time limits to be calculated from the date of the relevant illness,” he said.

Additionally, it is proposed that incentives be excluded from the salary used in calculating compensation to ensure fairness among beneficiaries.

Requirements for employers to submit annual income reports to the fund by 31 March each year have also been removed, allowing the director general to request these reports at any time, he added.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED