EABC, stakeholders demand regional tax harmonisation

THE East Africa Business Council (EABC) has appealed to governments to fast track harmonization of East African Community (EAC) macro-economic goals.

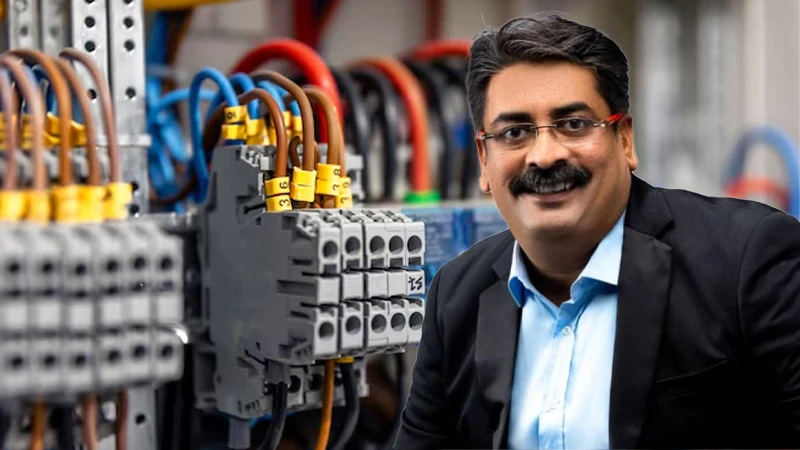

John-Bosco Kalisa, the EABC executive director, issued this appeal at a webinar yesterday on the pre-budget 2024/25 scenario, focusing on convergence and divergence of tax proposals across the EAC trading zone.

He urged harmonisation of domestic taxes to improve the business predictability of the zone, thus boosting intra-EAC trade and investment, noting that Tanzania, Kenya and Uganda share a common corporate tax rate of 30 percent.

Rwanda offers a marginally lower rate at 28 percent, which he said could influence decisions of major companies in relation to location of large investments.

Tanzania and Uganda offer simpler structures for withholding taxes with a flat rate or a tiered system of up to 20 percent, with Rwanda’s rate anchored at five percent and 15 percent.

Adrian Njau, the EACB trade and policy advisor, said that Tanzania and Kenya offer lower rates for service or management fees for residents (five percent) unlike the rate for non-residents, set at 15 percent.

Uganda by contrast sets six percent for residents and 15 percent for non-residents, with. Kenya applied a five percent rate for residents and 20 percent for non-residents.

Rwanda has a flat rate of 15 percent, he said, noting that these differences are not aligned with the EAC protocol on the free movement of services, as service providers offering cross-border services are treated as non-residents.

They hence need to take account for different withholding tax rates when pricing their services, with an impact on services intra trade and competitiveness, he stated.

Value added tax (VAT) on local goods and services shows disparities, with Tanzania applying a variable rate of 18 percent on most items, along with a reduced rate of 15 percent on certain essential goods.

By contrast Uganda and Rwanda maintain a standard rate of 18 percent while Kenya has a significantly lower rate of 16 percent.

Excise duties on services remain a complex issue in the EAC as Tanzania, Uganda and Kenya have specific rates for various services, whereas Tanzania charges telecommunication companies and payment service providers at 17 percent, with money transfer services taxed at 10 percent.

In Uganda, telecommunication firms face a 15 percent charge, while pay-to-view television services are taxed at five percent. Kenya applies a 15 percent charge on telecommunication services and a 20 percent rate for specified fees and charges levied by financial institutions, he said.

Excise duties on services in Rwanda are generally set at 15 percent, except for telecommunications services, which are taxed at 10 percent, he said.

Tax advisory firms called for alignment of the budgetary cycle in EAC partner states for timely engagement of the private sector, to draw up fiscal proposals to improve the trade and investment environment.

Experts at PricewaterhouseCoopers (PwC), an audit firm, assert that the private sector's proposals on Tanzania's budget include streamlining tax administration processes.

These involve clarifying dispute resolution procedures, expediting VAT refunds and aligning objection admission timelines. Notably, there's a call for tax reforms to support small and medium enterprises (SMEs), including a reduction of the corporate income tax (CIT) rate to 25 percent and exempting SMEs from the skills development levy (SDL).

Additionally, proposals advocate for progressive reductions in social security contributions over five years and exempting certain items from value added tax (VAT) to spur environmental conservation.

Moreover, there's a push to modernize the Excise Duty Act, with quick wins like reducing excise duty rates on telecommunications services and clarifying VAT thresholds for digital services.

“These proposals reflect a concerted effort to stimulate investment, foster entrepreneurship, and improve the competitiveness of Tanzanian businesses,” the director affirmed.

Kenya’s Finance Bill 2024o proposals are likely to impact cross-border trade in replacing the Digital Service Tax with a six percent significant economic presence tax, as it could increase costs for foreign digital service providers.

The introduction of a motor vehicle tax and removal of certain tax exemptions may raise operational costs for foreign investors and businesses involved in infrastructure and green bond projects, he said.

For the Uganda Financial Bill of 2024, measures like the waiver of penalties and interest for outstanding taxes will encourage compliance, potentially attracting foreign investments by reducing the tax burden on businesses.

Similarly, the introduction of capital gains tax on non-business asset disposals and withholding taxes on interest payments and commissions might increase costs, he elaborated.

Recent tax developments and proposed changes in Rwanda's Financial Bill showing a reduction in the corporate income tax (CIT) rate from 30 percent to 28 percent will decrease tax burdens for companies. The move stands to free up more capital for investment or expansion, he stated.

The webinar brought together over 150 notable stakeholders, including EAC partner states officials who discussed harmonizing taxation and monetary measures in the zone.

Traditionally, EAC ministers of Finance and Planning hold pre-budget consultations to agree on various tax measures before jointly unveiling their national budgets.

These consultations are a milestone in harmonizing the tax regime across the EAC, which has not yet been fully realized especially regarding domestic taxes like value added tax (VAT), excise duty and income tax, he added.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED