Tanzania ranked a good performer in African economic outlook for 2024, 2025

IN a new report titled “African Economic Outlook 2024: Driving Africa’s Transformation - The Reform of the Global Financial Architecture” African Development Bank Group surveys 54 African economies.

In this report, East Africa is likely to maintain its position as “Africa’s fastest growing region, with real GDP growth rising from an estimated 1.5 percent in 2023 to 4.9 percent in 2024 and 5.7 percent in 2025.”

In light of this, Tanzania is ranked a good performer in keeping the inflation rate at bay and in fiscal balance (the difference between government revenue and spending) and a fair performer in real GDP growth and current account balance (the sum of net exports of goods and services, and net primary and secondary incomes) for 2024 and for 2025 respectively, according to African Development Bank (AfDB) statistics.

At least 26 out of 54 surveyed economies are ranked good performers in keeping the inflation rate at bay in 2024 and given the current inflation trend 28 out 54 countries are projected to be good performers in 2025. In fiscal balance, 24 out of 54 countries are ranked good performers in 2024 and 27 out of 54 countries are projected to be good performers in 2025.

In real GDP growth (in which Tanzania is ranked a fair performer), 11 out of 54 countries are ranked good performers in 2024 and also 10 out 54 countries are projected to be good performers in 2025. In current account balance (in which Tanzania is also ranked a fair performer) 12 out of 54 countries are ranked good performers in 2024 and 12 out of 54 countries are projected to be good performers in 2025.

The 54 surveyed economies were ranked in three criteria: as good performers, fair performers and weak performers. In this ranking, countries with real GDP growth above 6 per cent were ranked good performers, those with the real GDP growth of 4-6 per cent were ranked fair performers and those below 4 per cent were ranked weak performers.

Countries with inflation rates below 5 per cent were ranked good performers, those with inflation rates of 5-9.9 per cent were ranked fair performers and those with double digit were ranked weak performers.

AfDB suggests that “the high rate of inflation across Africa is largely structural, driven by external factors as well as domestic food supply shocks. In such an environment, sustaining high policy rates may not be tenable, without imposing a cost on private sector growth, especially for small and medium enterprises.” It also recommends that as African central banks grapple with inflation to remain within acceptable limits, “monetary and fiscal policy coordination should be given a higher priority.”

Countries with current account surplus are ranked good performers, those with deficits below 5 per cent are ranked fair performers and those with above 5 per cent deficits are ranked weak performers. Countries with fiscal deficits below 3 per cent are ranked good performers, those with 3-5 per cent are ranked fair performers and those with above 5 per cent are ranked weak performers.

With regard to fiscal deficits, AfDB says updated estimates show that the average fiscal deficit on the continent increased slightly from 4.9 per cent of GDP in 2022 to 5 per cent in 2023, mainly due to “the marginal widening of the primary balance from 1.6 percent of GDP in 2022 to 2.1 per cent of GDP in 2023.” In this regard, Southern Africa and East Africa experienced an increase in their budget deficits, albeit to a lesser extent, from 3.7 per cent of GDP to 4.1 per cent and from 4.5 per cent of GDP to 4.8 per cent respectively.

Tanzania’s ranking went as follows: real GDP growth in 2024 was 5.7 per cent and its 2025 projection is 6.0 per cent, inflation in 2024 is at 3.3 per cent and its 2025 projection is at 3.4 per cent, current account balance in 2024 is -4.0 and its 2025 projection is -4.2 and fiscal balance in 2024 is -2.5 per cent and its 2025 projection is also -2.5 per cent.

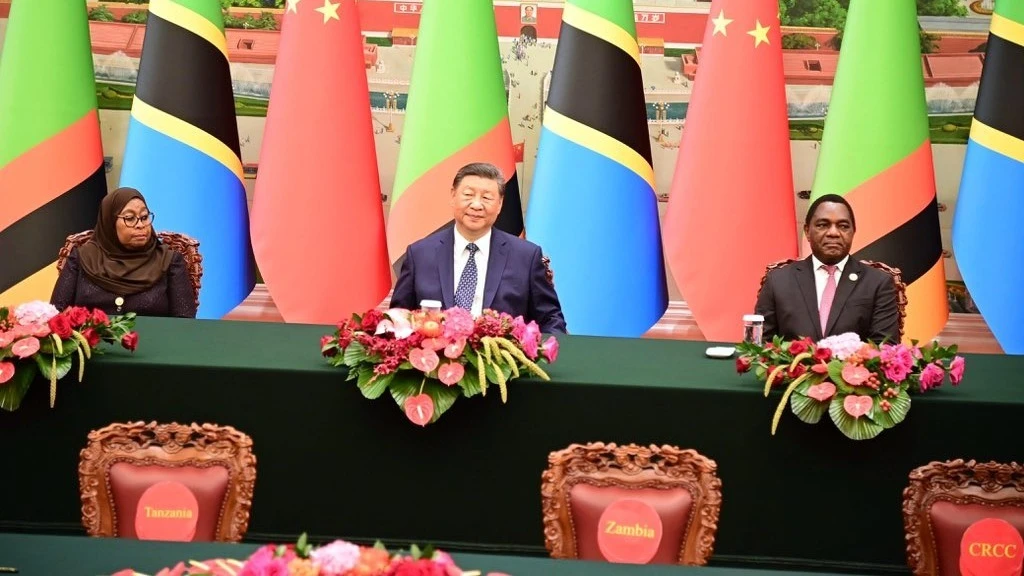

According to AfDB, economic performance in eight countries, namely Rwanda, Burundi, Tanzania, Ethiopia, Uganda, Kenya, Djibouti, and Côte d’Ivoire (in descending order) will benefit from increased public investments in major growth sectors (mainly manufacturing and services) and substantial capital outlays on critical public infrastructure, including electricity, transport, and logistics.

AfDB says that since January 2024 Africa’s Macroeconomic Performance and Outlook (MEO), 20 African central banks raised their policy rates as 5 lowered them, namely Botswana, Ghana, Guinea, Mozambique, and Zimbabwe. Furthermore, the report says the remaining 15 African central banks left their rate unchanged.

“Among the economies that increased policy rates, 6 of the 10 largest economies—Egypt +8 percentage points, Nigeria +6 percentage points, Kenya +2.5 percentage points, Angola +2 percentage points, Tanzania +1 percentage point, and Côte d’Ivoire +0.25 percentage point—account for 40 per cent of Africa’s GDP. African central banks are also using the Cash Reserve Ratio (CRR) as a monetary policy instrument.”

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED