IMF forecasts 3.3pc global economic growth in 2025/26

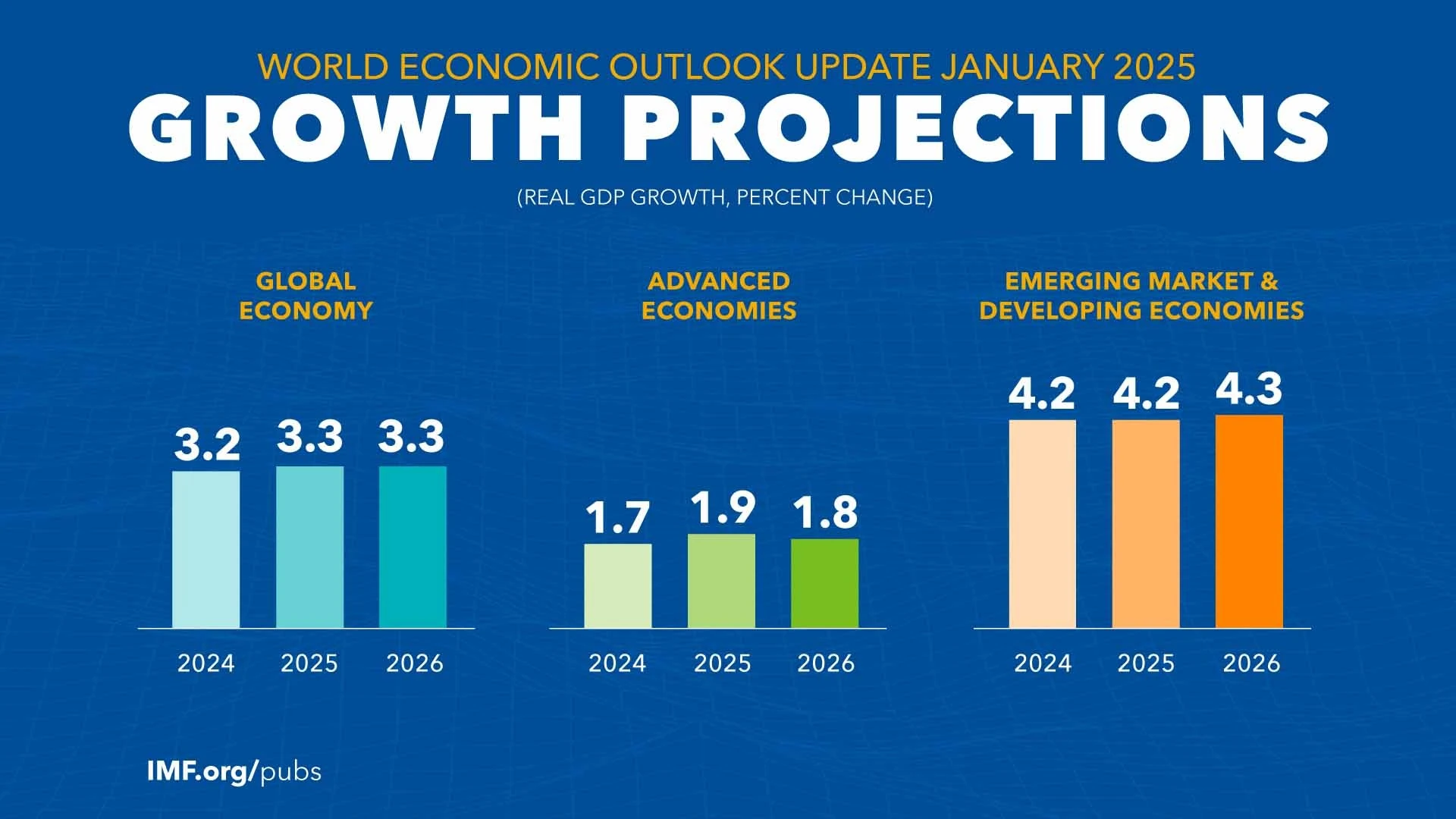

The International Monetary Fund (IMF) is projecting the global economic growth at 3.3 percent in both 2025 and 2026, below the historical (2000–19) average of 3.7 percent and broadly unchanged from October.

In its world economic outlook published yesterday, the Bretton institute says among advanced economies, growth forecast revisions go in different directions.

In the United States, underlying demand remains robust, reflecting strong wealth effects, a less restrictive monetary policy stance, and supportive financial conditions.

Growth is projected to be at 2.7 percent in 2025, being 0.5 percentage points higher than the October forecast, in part reflecting carryover from 2024 as well as robust labor markets and accelerating investment, among other signs of strength.

Growth is expected to taper to potential in 2026.

In the euro area, growth is expected to pick up but at a more gradual pace than anticipated in October, with geopolitical tensions continuing to weigh on sentiment.

Weaker-than-expected momentum at the end of 2024, especially in manufacturing, and heightened political and policy uncertainty explain a downward revision of 0.2 percentage point to 1.0 percent in 2025.

In 2026, growth is set to rise to 1.4 percent, helped by stronger domestic demand, as financial conditions loosen, confidence improves, and uncertainty recedes somewhat.

Growth in sub-Saharan Africa is expected to pick up in 2025, while it is forecast to slow down in emerging and developing Europe.

In other advanced economies, two offsetting forces keep growth forecasts relatively stable.

On the one hand, recovering real incomes are expected to support the cyclical recovery in consumption.

On the other hand, trade headwinds—including the sharp uptick in trade policy uncertainty— are expected to keep investment subdued.

In emerging market and developing economies, growth performance in 2025 and 2026 is expected to broadly match that in 2024.

With respect to the projection in October, growth in 2025 for China is marginally revised upward by 0.1 percentage point to 4.6 percent.

This revision reflects carryover from 2024 and the fiscal package announced in November largely offsetting the negative effect on investment from heightened trade policy uncertainty and property market drag.

In 2026, growth is projected mostly to remain stable at 4.5 percent, as the effects of trade policy uncertainty dissipate and the retirement age increase slows down the decline in the labor supply.

In India, growth is projected to be solid at 6.5 percent in 2025 and 2026, as projected in October and in line with potential.

In the Middle East and Central Asia, growth is projected to pick up, but less than expected in October.

This mainly reflects a 1.3 percentage point downward revision to 2025 growth in Saudi Arabia, mostly driven by the extension of OPEC+ production cuts.

In Latin America and the Caribbean, overall growth is projected to accelerate slightly in 2025 to 2.5 percent, despite an expected slowdown in the largest economies of the region.

Trade

World trade volume estimates are revised downward slightly for 2025 and 2026.

The revision owes to the sharp increase in trade policy uncertainty, which is likely to hurt investment disproportionately among trade-intensive firms.

That said, in the baseline, the impact of heightened uncertainty is expected to be transitory.

Furthermore, the front-loading of some trade flows in view of elevated trade policy uncertainty, and in anticipation of tighter trade restrictions, provides some offset in the near term.

Progress on disinflation is expected to continue. Deviations from the October 2024 WEO forecasts are minimal.

The gradual cooling of labor markets is expected to keep demand pressures at bay.

Combined with the expected decline in energy prices, headline inflation is projected to continue its descent toward central bank targets.

Inflation

The outlook says inflation is projected to be close to, but above, the 2 percent target in 2025 in the United States, whereas inflationary dynamics are expected to be more subdued in the euro area.

Low inflation is projected to persist in China. Consequently, the gap between anticipated policy rates in the United States and other countries becomes wider.

In the medium term, the balance of risks to the outlook is tilted to the downside, with global growth poised to be lower than its 2025–26 average and five-year-ahead forecasts at about 3 percent.

Near-term risks, in contrast, could reinforce divergences across countries: they are tilted to the upside in the United States, whereas downside risks prevail in most other economies amid elevated policy uncertainty and headwinds from ongoing adjustments (in particular, energy in Europe and real estate in China).

An intensification of protectionist policies, for instance, in the form of a new wave of tariffs, could exacerbate trade tensions, lower investment, reduce market efficiency, distort trade flows, and again disrupt supply chains.

Growth could suffer in both the near and medium term, but at varying degrees across economies.

Looser fiscal policy in the United States, driven by new expansionary measures such as tax cuts, could boost economic activity in the near term, with small positive spillovers onto global growth.

Yet in the longer run, this may require a larger fiscal policy adjustment that could become disruptive to markets and the economy, by potentially weakening the role of US Treasuries as the global safe asset, among other things.

Furthermore, higher borrowing to fund looser fiscal policy could increase demand for capital globally, leading to an increase in interest rates and possibly depressing economic activity elsewhere.

Confidence and positive sentiment in the United States, partly driven by deregulation, could boost both the demand and the supply side of the economy.

While relaxation of unduly tight regulations and reduced red tape for businesses may spur near-term US growth through higher investment, dollar appreciation could fuel risks of capital outflows from emerging market and developing economies and drive risk premiums upward.

Moreover, an excessive rollback of regulations designed to put limits on risk-taking and debt accumulation may generate boom-bust dynamics for the United States in the longer term, with repercussions for the rest of the world.

Downside risks to macro-financial stability may be amplified if compounded by a weaker fiscal outlook or stalled progress on structural reforms.

Other supply-side shocks, such as labor force disruptions driven by reductions in migration flows to the United States, may permanently reduce potential output and raise inflation during the adjustment period.

A near-term boost for the US economy emanating from these factors would further underscore the divergent growth patterns across economies.

If the adverse effects of tariffs and reduction in the labor force dominate, global activity as well as activity in the United States might be affected negatively in the medium term.

Uncertainties are high: the effects of each factor would unfold differently across countries, influenced by trade and financial linkages; policy responses to actions taken by other countries could play out in a variety of ways, including an escalation of retaliatory tariffs; and the impacts of different policy combinations or different magnitudes of policy changes could be quite different.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED