Firm host discussion on development insurance

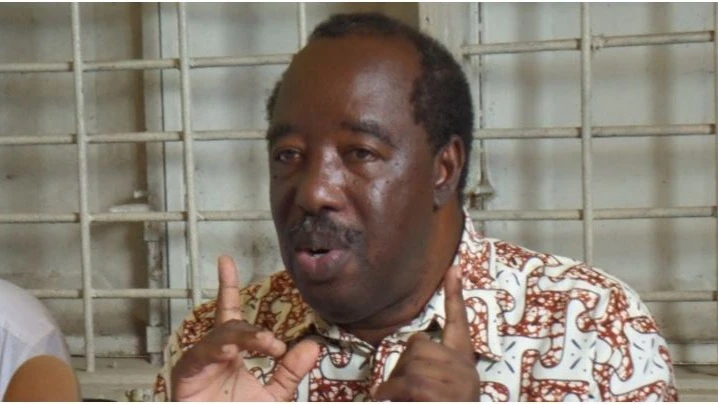

In an effort to promote the growing need for effective risk management in Africa, ATIDI hosted a webinar focused on the role of development insurance.

The session brought together media stakeholders from across the continent - to understand how innovative insurance solutions are driving sustainable development, mitigating risks and fostering economic growth.

With a special emphasis on the African market, the session provided a deep dive into strategies that are transforming the landscape of development insurance.

Development insurance plays a pivotal role in fostering economic growth by providing investment, trade and political risk-mitigation covers designed to attract foreign direct investment (FDI) into development projects.

Unlike traditional insurance, development insurance is a specialized field focused on creating a secure environment for investors by addressing unique risks.

ATIDI exemplifies this approach by offering tailored solutions that mitigate risks and provide investors with an added layer of security and confidence.

This assurance enables them to engage in critical development projects, knowing their capital and interests are safeguarded against unforeseen challenges such as political instability, currency inconvertibility and default risks.

Through its innovative and specialized products, ATIDI is not only facilitating FDI but also driving sustainable development across Africa, transforming perceived risks into opportunities for economic advancement.

ATIDI, legally known as the African Trade Insurance Agency, was founded in 2001 by African States and with technical and financial backing from COMESA and the World Bank, to cover trade and investment risks of companies doing business in Africa.

At that time, the continent attracted a bleak USD47 billion dollars of FDI, due in part to perceived or actual risk for interested investors. Though this figure has improved, Africa’s financing gap remains abysmal, with USD200 billion in additional investment needed to achieve the SDGs by 20301.

ATIDI has grown to 24 Member States and 13 institutional shareholders. The organization aspires to eventually have all African countries as members.

In pursuit of this goal, ATIDI has established and strengthened strategic partnerships with leading development and financing institutions, including the African Union, the African Development Bank, the World Bank Group, the European Investment Bank, KfW and Norad. ATIDI has earned an A2 rating with a stable outlook from Moody’s and an A rating with a stable outlook from S&P, reflecting its financial strength and credibility.

ATIDI has demonstrated resilience amid challenging market conditions, achieving profit growth while strategically managing its risk and exposure.

The organization continues to support trade and investment across Africa with a portfolio of over USD85 billion since inception.

ATIDI is implementing an ambitious 2023-2027 corporate strategy, targeting capital of USD1 billion and membership increase by 25 percent, while optimizing its processes and systems.

ATIDI has supported several flagship projects across Africa, showcasing its commitment to sustainable economic growth and financial stability.

The 20 MW Ituka West Nile Uganda Ltd solar project promotes renewable energy access. In Benin and Togo, ATIDI supported the refinancing and re-profiling of existing loans, underscoring ATIDI’s commitment to supporting financial stability and economic reforms.

Furthermore, ATIDI has been supporting key infrastructure transactions, including road and irrigation projects in Côte d’Ivoire, Tanzania, and Senegal among others. In all these countries, ATIDI’s comprehensive credit risk insurance enabled access to longer debt tenures, and a reduced all-in interest rate.

In collaboration with MDBs, ATIDI has provided cover for blended finance transactions such as in the BITA Water Project in Angola (World Bank), improving access to clean water and sanitation and an SDG loan in Benin (AfDB). Furthermore, ATIDI’s Regional Liquidity Support Facility (RLSF) enhances bankability by providing risk mitigation for development initiatives in renewable energy.

The pan-African development insurer is set to host its 2025 Annual General Meeting and Investor Roundtable in Luanda, Angola, from 18 to 21 June.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED