EQUITIES: Foreign investors record 21bn/-net selloff in Q1

Foreign investors recorded a net selloff of 21.8bn/- on the Dar es Salaam Stock Exchange (DSE) during the first quarter of this year, which was seven times of the value recorded during similar quarter of last year.

The market report summary shows that the turnover from share sold by foreign investor during the first three months of this year amounted to 26.1bn/-, which is equivalent to 45.49 percent of total value of shares sold, against buying value of 4.3bn/- of 7.61 percent.

During the first quarter of last year, foreigners sold shares valued 6.5bn/- which was equivalent to 67.79 percent of total value of shares sold, while the buying value amounted to 3.4bn/- equivalent to 82.88 percent of total value of shares bought.

Market analyst expect increased shares sell among foreign investors, specifically dormant blue chip counters, and gaining buying trends among active counters.

“We expect an increased involvement of buying shares among foreign investors during the next quarter as many are targeting dividends announcements in April and May,” said an analyst who spoke with The Guardian over the weekend.

According to the market report, a total turnover of 57.6bn/- was recorded during the first quarter of this year, which is 250 percent of the turnover recorded during the first quarter of last year.

Local investors dominated both market activities, after recording 54.51 percent of total value of shares sold ad 92.39 percent of total value of shares bought.

Total market capitalization declined by 800bn/- during the reviewed period, as it closed at 14.9trn/-, compared to 15.7trn/- recorded during the end of the first quarter of last year due to decrease of share prices for both locally listed and cross listed companies.

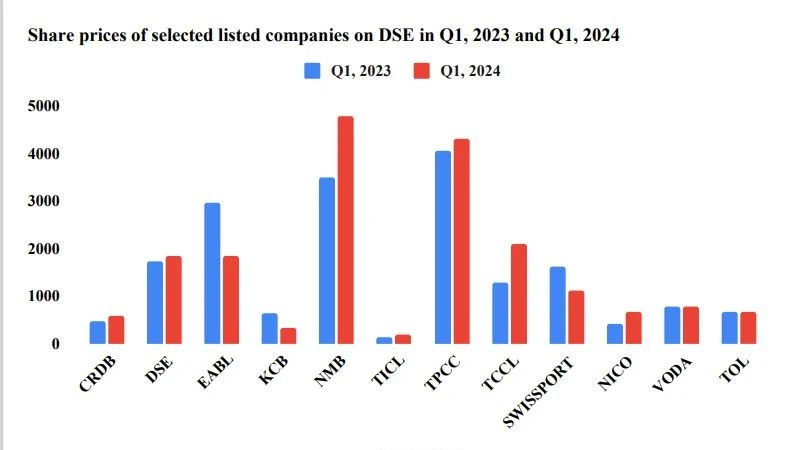

Counters which recorded an increase of share prices include CRDB Bank, which closed at 570/- at the end of the first quarter of this year, the historical high, compared to 475/- recorded at the end of the first quarter of last year, DSE Plc from 1,720/- to 1,840/-, NMB Bank which its share jumped to 4,780/- from 3,500/- and Tanga Cement (TCCL) which closed at 2,100/- from 1,280/-.

Other gained counters include TOL Gases, which its share increased to 660/- from 650/-, Tanzania Portland Cement Company (TPCC), which closed at 4,300/- from 4,060/- , NICO from 400/- to 650/-, NMG from 280/- to 310/- and TCCIA Investment company, which gained to 195/- from 140/-.

The market reports show counters which their share prices declined include East Africa Breweries Limited (from 1,840/- from 2,970/-), Mkombozi Commercial Bank (from 780/- to 630/-), DCB (from 170/- to 130/-), Maendeleo Bank Plc (from 395/- to 305/-), JATU ( from 290/- to 265/-) Jubilee Holdings Limited ( from 3,120/- to 2,980/-, KCB Bank from 620/- to 315/- and Swissport from 1,620/- to 1,100/-.

However, the reports shows the share prices of Precision Air (PA), Kenya Airways (KA), Swala, Tanzania Cigarette Company (TCC), Tanzania Breweries Limited (TBL), Vodacom Tanzania (VODA) Uchumi Supermarket Limited ((USL), TATEPA and Yetu Microfinance counters remained unchanged during the reviewed period.

According to the report summaries, Tanzania Share Index (TS) closed at 4,462.29 points during the end of the first quarter of this year, an increase from 4,091.56 points recorded during the end of the first quarter of last year while the DSEI declined to 1,790.24 points compared to 1,888.79 points respectively.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED