DSE’s mobile trading platform registers 38,000 investors

The Dar es Salaam Stock Exchange (DSE) Mobile Trading Platform (MTP) has so far registered cumulative 37,910 investors, of which 27,000 were recorded between January 2023 and December 2024.

epoPeter Nalitolela, the Chief Executive Officer, DSE, said this on Monday when he was presenting the market performance for the year ended in December.

He said during the reported year, the MTP registration grew by 397 percent to 22,774 last year from 4,578 registered in 2023, driven by enhanced platform, increased awareness and investor confidence due to strong market performance.

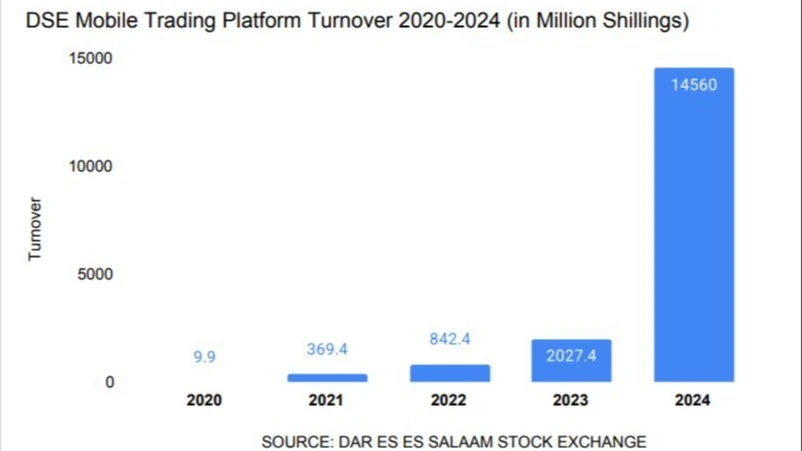

The platform’s turnover also grew by 618 percent to 14.56bn/- last year from 2.03bn/- in 2023.

Data show the MTP contribution to turnover, excluding pre-arranged transactions, increased six-fold to 24.33 percent in 2024 from 4.84 percent in 2023, underscoring the rising adoption and efficiency of platform.

MTP now accounts for nearly a quarter of DSE’s total market turnover, compared to less than 5 percent during 2023 as the growth reflects a significant shift towards digital trading, driven by improved accessibility, investor confidence and robust market performance.

Top counters via MTP included CRDB, which recorded a turnover of 5.2bn/- which accounted for 82.21 percent of total platform turnover, followed by NMB, which contributed by 5.01 percent and NICO, which contributed by 4.39 percent.

“CRDB Bank’s exceptional performance indicates strong investor confidence and trading activity while the combined contributions of NMB and NICO reflect their growing presence on the platform,” Nalitolela said in a statement.

Generally, the DSE total market capitalization, which include domestic and cross listed companies increased by 22.29 percent to 17.9trn/- in 2024, from 14.6trn/- recorded in 2023, while domestic market capitalization expanded by 7.38 percent to 12.2trn/- from 11.4trn/- respectively.

The overall increase reflects a mixed performance influenced by economic factors, investor sentiment and recovery momentum in both domestic and cross listed counters.

The equity trading turnover reached 228.6bn/-, a 1.52 percent increased from 225bn/- recorded in 2023.

According to the CEO, a one-off transaction on the Tanga Cement counter (TCCL), valued at 106bn/-, accounted for a significant portion of turnover of 2023, as by excluding it, the turnover for 2024 would show a 91.5 percent increase compared to 2023.

During the reported period, a total of 228 million shares were traded in 2024, reflecting a 21.28 percent rise compared to 188 million shares traded in 2023, driven by mobile trading, increased participation by both local foreign and local investors and strong performances of listed companies.

Indices

The Tanzania Share Index (TSI), which measures the performance of locally listed companies increased by 7.30 percent to 4,618.78 points from 4,304.4 points driven by appreciation in share prices of domestic companies including Afriprise, Tanga Cement (TCCL), Nicol, NMB Bank, CRDB Bank, DCB Bank and self-listed DSE.

The report shows the all share index (DSEI) grew impressively by 22.22 percent to 2,139.73 points from 1,750.63 points, driven by price increase in domestic counters and cross-listed companies such as KCB, EABL and Jubilee Holdings Limited.

“DSEI growth reflects robust market-wide growth, including contributions from cross-listed stocks, showing improved market confidence and attractiveness of investors,” the report notes.

On bond market, the report shows that the turnover was 3.1trn/-, a 13.6 percent decrease from 3.6trn/- in 2023 due to re-opening of Bank of Tanzania (BoT) auctions, encouraging investors to prioritise the primary market over the secondary market and decline in market prices, especially low-rate bond.

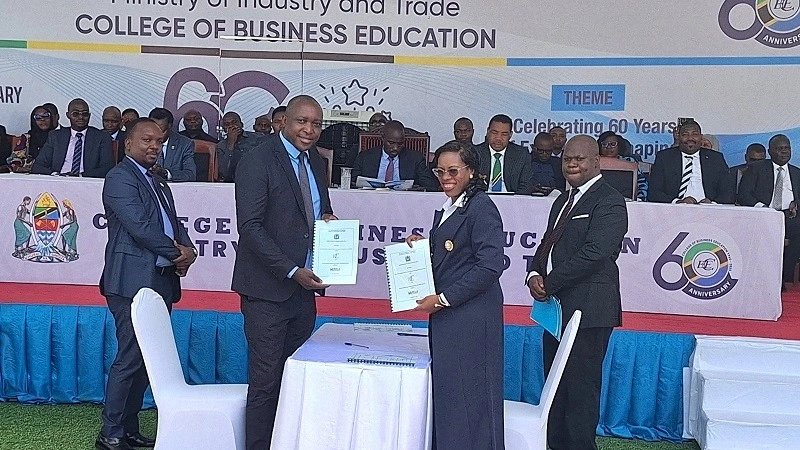

Meanwhile, DSE has signed a Memorandum of Understanding (MoU) with Tanzania Institute of Bankers (TIOB) to enhance financial market in Tanzania’s capital markets.

The signing of the deal made held yesterday in Dar es Salaam by DSE chief Executive Peter Nalitolela and TIOB executive director Patrick Mususa.

The partnership is aimed at including capital markets education on TIOB syllabus, the use of technology to increase awareness on capital markets among banking experts, to enhance accountability, formulate products and services for capital markets and enhance education awareness on Environment, Social and Governance (ESG) in financial sector.

TIOB executive director Patrick Mususa said is optimistic on the partnership with DSE.

Dar es Salaam Stock Exchange (DSE) chief executive officer Peter Nalitolela (L) speaks with journalist when presenting the market performances for 2024. Right is the DSE’s director of Business Development Emmanuel Nyalali DSE. Photo: Guardian Photographer

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED