‘Closing the small business productivity gap can significantly boost economies’

MICRO, small and medium-size enterprises (MSMEs) play an underappreciated and outsized role the global economy.

They account for 90 percent of all businesses, half the value added, and more than two-thirds of business employment. In Indonesia, for example, they account for almost 90 percent of employment and two-thirds of value added. Small businesses also inject dynamism into economies.

Many large companies of today were MSMEs not long ago. About one in five of today’s very large companies – defined as having a market capitalization of more than $10 billion in the United States and equivalent values in other economies – were MSMEs at some point after 2000 and have since powered their way to large company status.

Yet small businesses struggle with productivity in comparison with large companies. Raising MSME productivity has long been an aim of governments who recognize their central role in economic growth and employment.

Benefits of narrowing the MSME productivity gap

McKinsey Global Institute’s recent A microscope on small businesses: Spotting opportunities to boost productivity report analysed MSMEs in 16 economies and found that narrowing the productivity gap could represent value equivalent to 5% of gross domestic product in advanced economies and 10 percent in emerging ones. The question is how best to capture that value.

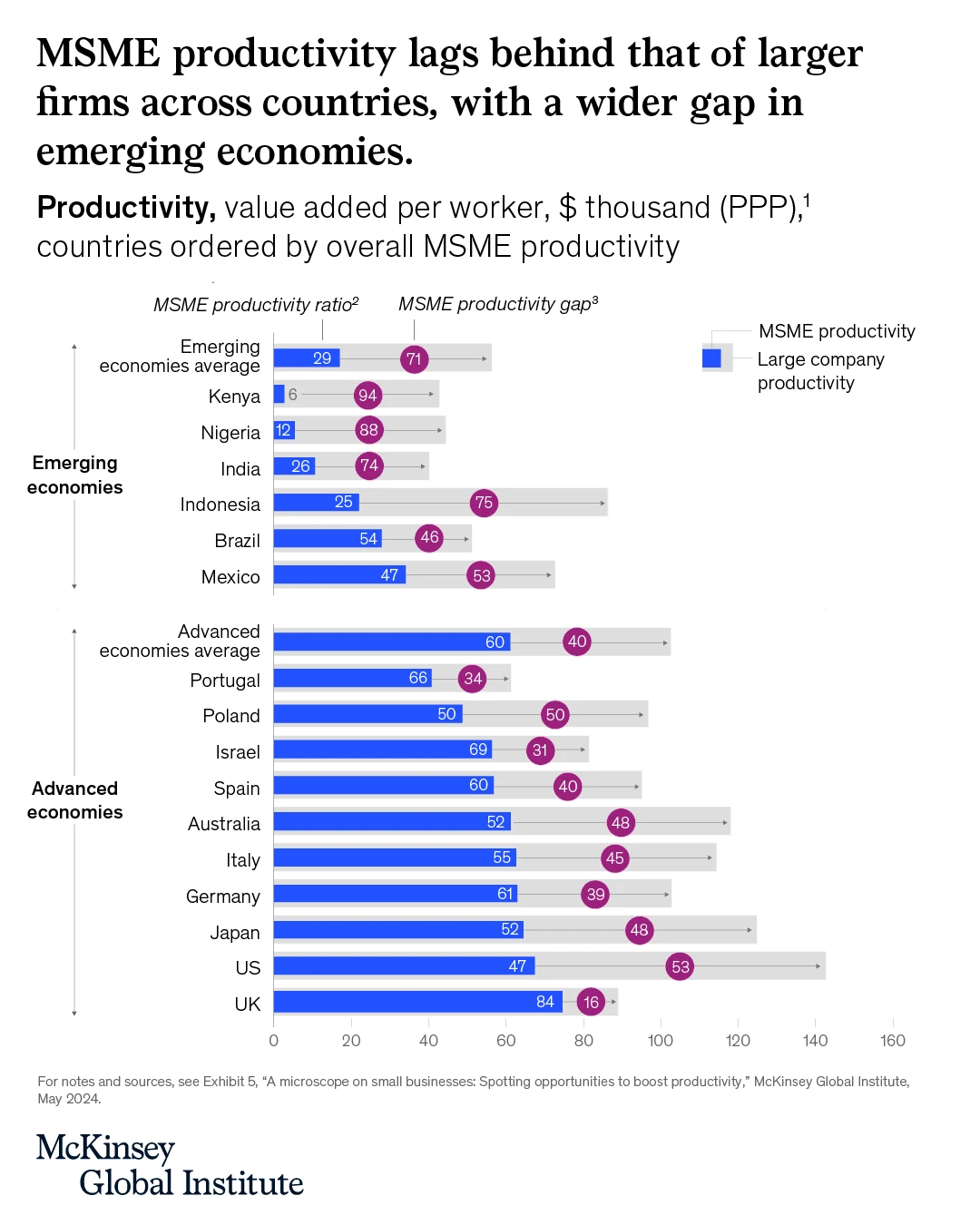

Overall MSME productivity is only half that of large companies, and less in emerging economies. In India and Indonesia, for example, small businesses are only one-fourth as productive.

But this is very much an average. In truth, productivity performance varies enormously widely amongst MSMEs depending on the country in which they operate, the sector and even the subsector.

In India, for instance, MSMEs in the manufacturing sector achieve 14 percent of the productivity of large companies, whereas in administrative services, their productivity is 32 percent. Conversely, in Indonesia, small businesses in manufacturing are 40 percent as productive as their large counterparts, but only 10 percent as productive in administrative services.

How the MSME does business is important, too. Business-to-business MSMEs that interact closely with other companies, often larger ones, have a 40 percent smaller productivity gap with those larger enterprises than business-to-customer MSMEs that sell primarily to individuals –in five sectors that offer the most potential value.

Indeed, being part of a business network is a major factor in MSMEs’ productivity performance – but also in the performance of the large companies in their networks. Looking around the world, in two-thirds of subsectors, the fortunes of MSMEs and large companies are correlated and go hand-in-hand; a win-win.

Take the trade sector in Japan as illustration. In automotive trade, Japan’s MSMEs are more vertically integrated with large manufacturers than in many other advanced economies, including the US. This enables them to have more efficient logistics that follow just-in-time principles and respond effectively to market fluctuations.

They are top-quartile productivity performers. But in retail and wholesale trade – excluding automotive trade – vertical integration appears to be weaker, and Japan’s MSMEs fall into the bottom two quartiles of relative performance.

To be continued…

The article was jointly authored by Olivia White and Anu Madgavkar, both from McKinsey & Company.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED