Cashew nuts export flying high as earnings hit $450m

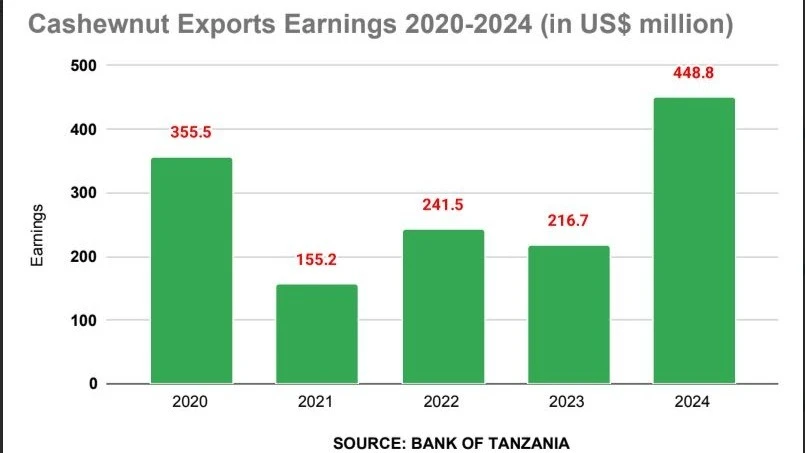

Cashewnuts is about to regain its position as top traditional exports earning crop, after injecting a total of US$448 million during the year ending November, 2024, more than the double of US$216 million earned during the year ending November 2023.

The amount was an increase from US$279 million recorded during the year ended October, 2024.

Provisional data by the Bank of Tanzania (BoT) show that cashew nut is currently the second top traditional earning crop behind tobacco which has so far earned US$480 million, during the year ending November, 2024.

The increase of cashew nut exports has also boosted the traditional exports earnings to US$1.35bn, which is nearly equivalent to total earnings from manufactured goods.

With ongoing cashew nut exports and data collections, there is an indication that the crop will surpass dominant tobacco, as the final crop’s trading data will be released by the end of April this year.

The increase of exports earnings from the crop, currently mostly grown in Mtwara, Ruvuma, Lindi and Pwani, resulted from an increase of production and global demands, which stimulated the commodity price.

Cashew nut Board of Tanzania (CBT) Director General Alfred Francis told The Guardian yesterday that during the last season, the crop production increased to 408,000 tons from 310,000 tons recorded during the previous year.

“There has been an increased demand for cashew nut in the global markets, which pushed up the price and this motivate farmers to improve their farming to produce more in the coming seasons,” he said in an interview yesterday.

Francis said the CBT is currently working to expand cashew nuts growing, as new seeds are currently being distributed in new growing regions such as Dodoma, Singida, Tabora, Rukwa, Songwe and Morogoro.

“Our target is to increase the volume of production from these new regions through distribution of seeds and enhancing extension services,” he said.

He said the board has hired 500 youths through Building Better Tomorrow (BBT) programme to enhance farmers registration and extension services.

Komba Petro, an agronomist and agri-business stakeholder in cashew nuts value chain said the increased demands for cashew nuts should be part of motivation to encourage the expansion of the crop production.

He said the increase of price of the commodity also helped the crop to increase its exports earnings as during the current season, which motivated farmers, as the price went up to the maximum price of 4,000/- per kilogramme.

The agronomist said the government efforts, specifically the distribution of inputs and pesticides by the crop board as well as good management of Agricultural Marketing Cooperative Societies (Amcos) were among of the factors that enabled the crop trading successful.

“These achievements have motivated farmers to boost best agro-economic practice, which will also enable the increase of future production,” he said yesterday.

At the macro-economic level, he said the crop has boosted the country’s foreign exchange inflows.

Data from Tanzania Commodity Exchange (TMX) show that as of early December, Tandahimba Cooperative Union (TANECU) purchased 114,662 tons valued 429bn/-, followed by MEMCU which purchased 104,974 tons valued 387.4bn/- while Coast Regional Cooperative Union (CORECU) purchased 19,801 tons valued 67.6bn/-

UKICU purchased 329,103 tons valued 903bn/- while LINDI and RUNALI unions purchased 41,321 and 65,040 tons respectively valued 148bn/- and 244bn/-.

From the end of October last year until February this year, the Maersk-introduced ‘Korosho Express’ is running bi-weekly services from the Mtwara port in southern Tanzania to meet the growing demand for cashews from Tanzania.

The Danish line’s head of its East African market division, Babafemi Jay Aderounmu, said in October last year that the service specifically tailored for cashew exports.

“By offering reliable, scheduled services during the peak cashew season, we're enabling more efficient trade flows and supporting the growth of this vital export commodity," he said.

The Korosho Express service confirms Tanzania’s rise as a leading cashew grower in Africa.

The country has positioned itself as a key player in the global cashew trade but faces strong competition from West African countries like Côte d'Ivoire, the world’s top cashew producer.

Despite being a major producer, only about 10 percent of cashews are processed domestically, with the rest exported in raw form, mostly to India and Vietnam, which has led to substantial value loss.

Data show between 2008 and 2013, it is estimated that Tanzania lost approximately $551 million by exporting unprocessed cashew nuts instead of adding value domestically.

Efforts are now under way to revamp this situation, with initiatives focusing on improving processing capacity and developing cashew by-products.

Tanzania’s long-term cashew strategy includes goals to increase production to over 1.7 million metric tonnes annually, alongside improving processing capabilities and market diversification.

Global demand for cashew nuts is increasing, driven by health consciousness, culinary versatility, and the growth of plant-based diets as they contain high in healthy fats, proteins, vitamins, and minerals with low in sugar and high in unsaturated fats.

Data show the global cashew nuts market size was evaluated at $8 billion in 2022 and is slated to hit $11 billion by the end of 2030 with a CAGR of nearly 4.5 percent between 2023 and 2030.

The global demand for cashew nuts is notably strong in Europe and North America. Countries such as Germany lead in European consumption due to a growing preference for organic and health-oriented products.

The presence of major companies involved in processing and packaging cashews enhances market dynamics, contributing to steady consumption growth.

In North America, healthier snacking options continue to drive up demand for cashew nuts as consumers’ seek alternatives that align with their dietary preferences as the cashe wnuts snacks market is expected to grow at a CAGR of 3.7 percent between 2023 and 2030.

A key challenge for the cashew nut snacks market is the intense competition from alternative plant-based snacks.

As consumer preferences shift towards healthier options, other nuts like almonds and peanuts are gaining popularity due to their lower price points and perceived health benefits.

According to Grandview research, the online sales of cashew nut snacks are expected to grow at a CAGR of 3.6 percent from 2024 to 2030.

The growth of online distribution channels is a major driver for the cashew nut snacks market, largely fueled by the increasing penetration of e-commerce and changing consumer shopping habits.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED