BoT records net sale of $2.5m in forex for July

The Bank of Tanzania (BoT) recorded a net foreign exchange sale of US$2.5 million in July 2024, a sharp increase from the US$0.25 million recorded in June 2024.

This rise in forex sales was driven by heightened activity in the Interbank Foreign Exchange Market (IFEM), where commercial banks sold US$7.7 million during the previous month.

The BoT actively participated in both buying and selling operations in the forex market, following its intervention policy directives.

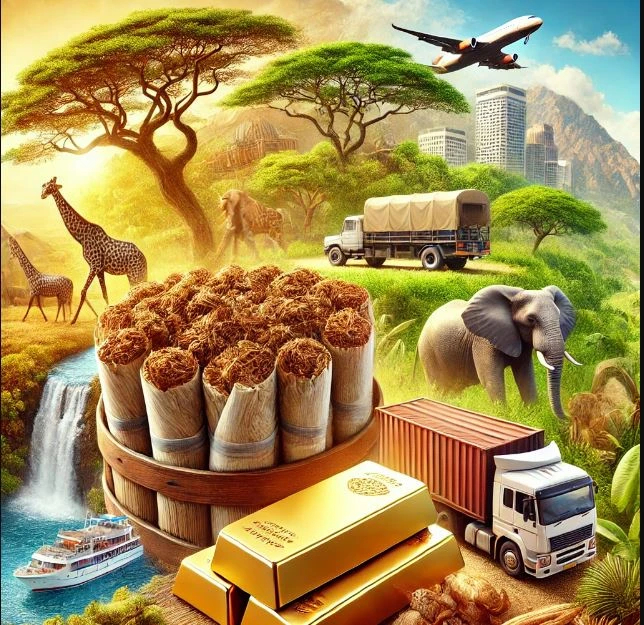

The increase in foreign exchange transactions was largely attributed to seasonal factors, including a boost in tourism and crop exports, which lifted market activity.

“Foreign exchange transactions surged in July, driven by a seasonal boost in tourism and crop exports,” noted BoT in its August 2024 Monthly Economic Review.

Additionally, steady gold exports continued to play a crucial role, with gold remaining Tanzania’s top export commodity, generating US$3.1 billion in the year leading up to July 2024.

While exports increased, a slight decline in imports helped improve the overall current account balance.

The volume of transactions in the IFEM rose to US$15.3 million in July from US$9.3 million in June 2024.

The Tanzanian shilling saw some depreciation, with the average exchange rate standing at 2,663.76/- per US dollar in July, compared to 2,626.07/- in June.

On an annual basis, the shilling depreciated by 12.6 percent, although the BoT reported no significant misalignments in the exchange rate.

Looking ahead, forex inflows are expected to further increase, driven by high global gold prices, a rise in tourism, and stronger exports of key cash crops such as cashew nuts, tobacco, coffee, and cotton, as well as food exports to neighboring countries.

The BoT’s domestic gold purchase program is also expected to bolster foreign reserves, which exceeded US$5 billion at the end of June 2024, sufficient to cover over four months of projected imports.

Gold's role in the economy remains crucial, supported by stable mining output and favorable global prices.

Together with traditional exports and tourism, the gold sector continues to anchor Tanzania’s foreign exchange earnings.

Foreign currency liquidity showed slight improvements towards the end of June, aided by inflows from gold, tobacco, and tourism.

As one of Tanzania's key cash crops, tobacco exports saw an increase during the month, benefiting from favorable market conditions and increased demand from international buyers.

Provisional data by BoT show that the exports earning of tobacco reached US$445 million during the year ended in July this year, more than double of US$214 million recorded during the year ended in July 2023.

The BoT also plans to diversify its foreign reserves portfolio by purchasing gold from local markets.

This effort, alongside measures to reduce dollarization in domestic transactions, is expected to ease pressure on foreign exchange liquidity.

Despite some depreciation in the second quarter, with a 2.2 percent decline in the IFEM exchange rate compared to a 1.8 percent decline in the first quarter, foreign exchange liquidity pressures eased as inflows from gold and tobacco increased.

The retail exchange rate also saw a 3.2 percent depreciation, up from 1.9 percent earlier in 2024.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED