AMCOS eye majority ownership in proposed cooperative bank -3

THE Agricultural Marketing Cooperative Societies (AMCOS) and other cooperative unions have opted to inject a reasonable collective working capital in the Kilimanjaro Cooperative Bank Limited (KCBL) with the intention of achieving a 51 percent share ownership in the newly designed Cooperative Bank of Tanzania (CBT).

The anticipated investment percentage in the bank’s portfolio is mostly likely to guarantee cooperative union members the ownership of the KCBL which shall be transformed into the CBT before the end of this year.

The decision comes after the Cooperative Societies under the custodian of the Tanzania Cooperative Development Commission (TCDC) have started investing in the KCBL and in economic projects for the purpose of transforming cooperatives operations to modern commercialized approaches and therefore generating handsome profits that will benefit members through the accumulation of handsome annual dividends.

Speaking to this journalist in separate interviews recently, some leaders from various cooperative unions expressed their intention of investing in the new bank which is expected to start providing financial services this year through the purchase of its shares.

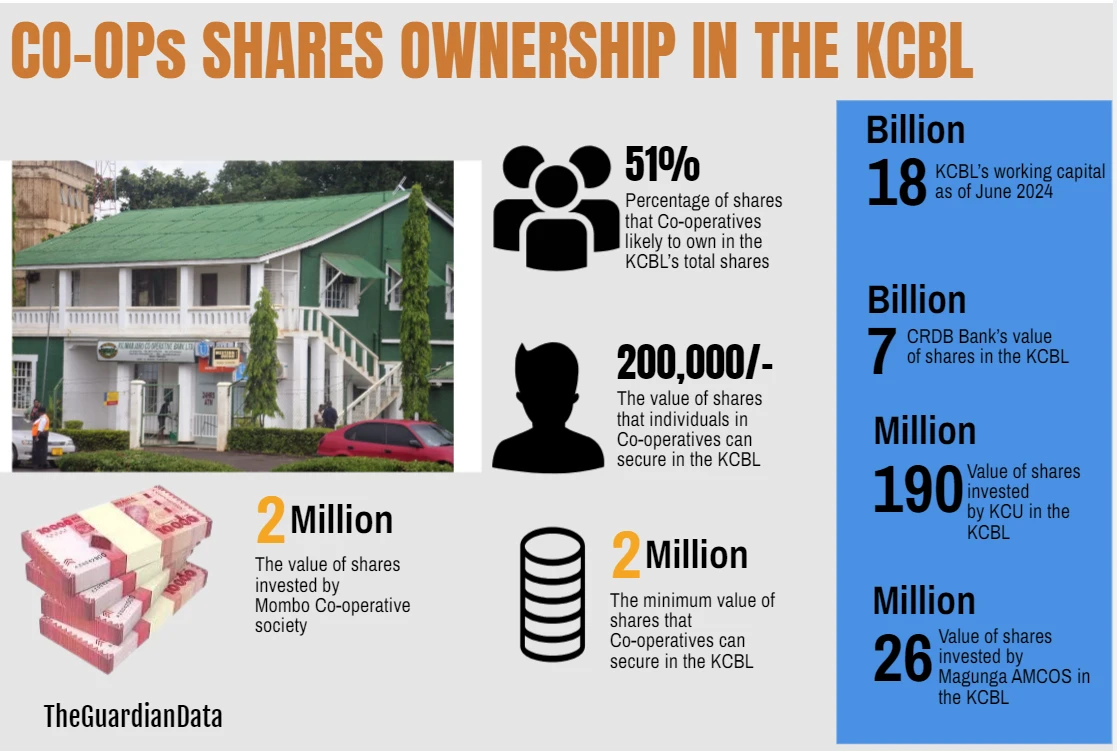

Ress Mashurano, Chairperson Kagera Cooperative Union (KCU) said that the union formed by 141 AMCOS has already invested shares worth 190mn/- in the Kilimanjaro Co-operative Bank Limited (KCBL) which is one of the two banks that are merged under the Bank of Tanzania (BoT) to form the CBT.

"It is important for cooperative unions to ensure that this bank becomes theirs through the ownership of a large percentage of its shares. We need a strong common voice for decision-making in the bank;

We at KCU believe that this bank will be safe under the ownership of Co-operative unions and not private investors," said Mashurano.

Monica Fidelis, Extension Officer and member of Magunga AMCOS in Korogwe district in Tanga region said that the AMCOS has invested shares worth 26mn/- in the capital of KCBL to ensure that it becomes part of the ownership of the new CBT bank.

"The plan of establishing the cooperative bank has been there since 2012. There was a working capital benchmark challenge for KCBL several years after the plan was put in place and it led to delays of its establishment;

We are currently encouraging each other to buy shares so that we have ownership that gives us the right to make final decisions," said Monica.

Jeremiah Pastory, KCBL Sales and Marketing Officer told The Guardian that CBT shareholders are categorized into six groups namely: cooperative unions, individuals, companies, government institutions, non-governmental organizations and community groups.

He said cooperative unions should have 51 percent majority ownership because they are the core owners of the bank and the remaining 49 percent should be owned by other shareholders.

"The process of transforming KCBL into a national Co-operative bank began in 2012. As of 2020, it was placed under the supervision of CRDB Bank Plc for four years until the end of this year where CRDB invested shares worth 7bn/- apart from deployment of five executives," Pastory said.

Pastory asserted that as of June this year, KCBL has managed to raise its working capital to 18bn/- while cooperative unions own 48 percent of shares, which is a shortfall of 2bn/- worth of shares needed to close the 51 percent ownership gap.

"That is why we have been in a campaign to encourage Co-operative unions to invest in their bank. When cooperative unions have a large ownership, it will make CBT prioritize the allocation of reasonable loans to cooperatives at low interest rates and that will be the difference with other commercial banks," said Pastory.

He explained that KCBL will be merged with Tandahimba cooperative Bank Limited (TCBL) to form the CBT.

According to him, CRDB Bank Plc has already invested shares worth 3.2bn/- in TCBL to enable it to strengthen itself with the merger that is expected to bring about an investment revolution in the cooperatives sector.

Pastory asserted that currently the sale of shares is ongoing whereby individuals in cooperative unions are allowed to buy shares valued up to 200,000/- which is equal to 400 shares whereas for cooperatives the minimum investment capital is 4,000 shares which is equal to 2mn/- .

Samson Mwende, Chairperson Mombo Irrigation Scheme Agricultural cooperative society Limited, Korogwe Rural district in Tanga region said that the cooperative has so far invested 2mn/- in shares of the proposed bank.

"We did the investment of shares in KCBL at the beginning of this year; we expect it will enable us to become part of the ownership. There is a plan to invest another 2mn/- before the share purchase window is being closed," said Mwende.

Minister for Agriculture Hussein Bashe said that CBT will commence the offering of services with effect in September this year if all plans are well-organized with four branches namely: Dodoma, Kilimanjaro, Tandahimba and Tabora town.

"There will be maximum collaboration between the bank, the Agricultural Inputs Trust Fund and the Tanzania Agricultural Development Bank (TADB) in the execution of its duties. This partnership aims to strengthen financial services meant for Co-operatives," said Bashe.

Dr Cyril Komba, Senior Lecturer and Dean Faculty of Co-operative and Community Development, Moshi Co-operative University (MoCU), said that in South Africa cooperatives own many banks where there is no need for members to seek high interest loans from commercial banks.

He said that as at the end of last year, South Africa had more than 20 cooperative banks providing services to its members. Kenya comes first in the East African region with more than three cooperative banks.

According to the South African Co-operative Banking Sector Development Strategy of 2021 as prepared by the Cooperative Banks Development Agency in collaboration with the World Bank, in the decade following the end of apartheid, development partners provided assistance to grow the cooperative bank system based on the model of credit unions whereby all users are members.

The strategy states that these early efforts focused on developing a strong, independent association of cooperative banks that could aid with a ‘train the trainer’ approach.

The cooperatives operated under Exemption Notice No. 2173, which required membership in the Savings and Credit Co-operative League of South Africa (SACCOL) as a self-regulatory organization.

On the other hand, the South African Co-operative Banking Strategy Implementation report released in September 2023 by the Co-operative Strategy Implementation Steering Committee (SISC) there are about 29 Cooperative Banking Institutions (CBIs) and Co-operative Financial Institutions (CFIs), representing nearly 30,000 members, with the average membership of individual CBI being 1,000.

Collectively, cooperatives have mobilized over R400m in savings, which offers basic savings products. The total assets of the cooperative sector are over R500m.

It states that about R350m has been lent out to members in the form of loans; the majority of these loans are personal, and there is a trend toward productive loans (enterprise and housing loans). Relative to the assets in the sector, lending is very low.

“The main challenge is for the most of registered CBIs organized as community-based banks or as association-based, such a trade union based CBIs, as their common bond of membership;

There are also workplace and employer-based CBIs. In that regard, SISC proposes the establishment of the National Secondary Cooperative Bank to cater for existing and future possible challenges,’ reads part of the report.

To be continued.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED