Govt scraps VAT on fertiliser, gold sold to refineries, edible oil seeds

THE government has proposed a number of tax reforms which among other things, zero rate Value Added Tax (VAT) on fertilizer manufactured locally for a period of one year to zero rate VAT on textile products (fabric and garments) made using locally grown cotton.

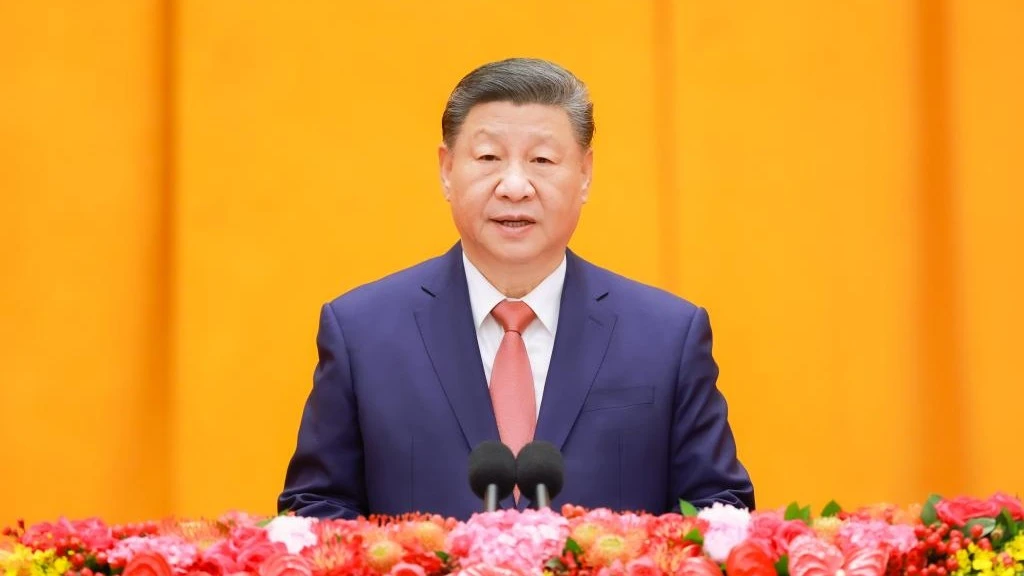

Tabling the 49.35trn/- national budget for the 2024/25 fiscal year yesterday in the National Assembly, Minister for Finance and Planning, Dr Mwigulu Nchemba.

Earlier budget profiles showed that recurrent expenditure will rise to 32.1trn/- up from 29.23trn/- during fiscal 2023/24, allocating 15.74trn/- for debt servicing, slightly over a third of total recurrent expenditure.

Last week the minister informed MPs that the government's 2024/25 budget is expected to total 49.35trn/-, a noticeable increase from 44.39trn/- in the outgoing fiscal plan, partly tied with currency depreciation.

Grants and concessional loans amounting to 5.13trn/- are expected in the 2024/25 budget from development partners, chiefly multilateral and bilateral lenders.

Noticeable tax changes include zero rating VAT on gold supplied to domestic refineries to promote the growth of domestic refineries, plus subsidising agricultural inputs including fertilizers, farming equipment, pesticides and quality seeds.

The minister proposed exempting VAT on supplies of double refined edible oil from locally grown seeds conducted in local industries, to stem increased price of edible oil in the global market.

The government also aims to provide relief to farmers and consumers as well as abolish VAT on supply of precious metals, gemstones and other precious stones at refineries.

Strategic fiscal measures will be imposed to contain rising prices of imported crude edible oils to local producers to increase production, reduce prices and increase employment, he said.

To increase agricultural production and productivity and relieve farmers, excise duty on locally produced bottled water with HS Code 2201.10.00 and 2201.90.00 is cut from 63.80/- to 58/- per litre in order to support the growth of small scale factories producing water in the country, provide relief to consumers, and promote the use of clean and safe water.

VAT on the supply and importation of agricultural implements with HS Code 8201.10.00 (spades and shovels) and HS Code 8201.30.00 (mattocks and picks) is abolished to reduce acquisition cost of agro-net, to support the growth of the agriculture sector, ensure high productivity, good yields and improve livelihoods.

He proposed to amend the Sugar Industry Act, CAP 251 to give power to the National Food Reserve Agency (NFRA) to buy, stock and reserve sugar as a national food reserve requirement to cover domestic consumption during seasonal sugar gaps.

“This measure is intended to ensure constant availability of sugar in the country and manage hoardings of sugar products by manufacturers without compromising the protection of local industries,” he stated.

Tax and levy reforms that the budget proposes are intended to promote growth particularly in agriculture, industry, enhancing purchasing power, boosting government revenues.

Priority areas for the proposed 49.35trn/- 2024/25 budget includes debt servicing, preparations for coming elections and preliminary readiness for the 2027 African Cup of Nations (AFCON).

An increase of 11.2 per cent in the budget is mainly driven by debt increase associated with shilling depreciation, rise of interest rates and maturity of loans, alongside new employment arrears, he stated.

Spending will include 15.74trn/- for servicing public debt and other consolidated fund expenses; 11.77trn/- for salaries, including recruitment and promotion of employees and 2.17trn/- for railway, roads, water and REA funds.

Other expenditure will include 1.19trn/- to finance higher learning education and tertiary colleges student loans, and the fee free primary and secondary education programme.

In preparation for hosting AFCON 2027, the government will start constructing and rehabilitating soccer stadiums.

Implementation of the 2024/25 national budget may be affected by risks associated with changes in economic, financial, budgetary, political, and diplomatic situations, he said.

Other risks relate to cross-cutting issues including climate change, natural disasters, outbreaks of diseases and geopolitical tensions.

Some of the impacts of the aforementioned risks include failure to achieve revenue collection targets; slow pace of project implementation; increased cost of production; plus debt servicing and borrowing costs.

Decrease of grants and concessional loans from the development partners, rising budget deficit, decline in agricultural production, infrastructure damage and larger claims and arrears from suppliers and service providers are also anticipated.

Measures to mitigate the potential risks in order to achieve goals and targets of the 2024/25 budget implementation include overseeing requisite monetary and fiscal policies plus enhancing electronic revenue collection systems.

Other measures are improving the investment environment for domestic and foreign investors and overseeing the implementation of the Loans, Grants and Guarantees Act, CAP 109.

Monitoring the national risk management framework for Public institutions, strengthening the management of the National Disaster Fund; enhancing good governance and the rule of law, plus implementing the national strategy for strengthening availability of foreign currencies are envisaged, he added.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED