ECONOMIC DEVELOPMENT: Shifting Africa’s financing for development paradigm

UNDER-SECRETARY-GENERAL and Special Adviser of United Nations Secretary-General on Africa, Cristina Duarte reflects on the generational importance of the Summit of the Future called for by Secretary-General António Guterres to support Africa’s claim of its rightful place at the global leadership table.

Our world continues to reel from multiple crises, facing a trifecta of challenges related to financing, climate, food and energy that are exacerbated by the lingering effects of the COVID-19 pandemic.

But we should “Never let a good crisis go to waste,” as a former statesman reportedly said after World War Two, a difficult period in human history that ultimately led to the creation of the United Nations.

The parallel is fitting as we mobilize to address the challenges of our time by answering the call of the current United Nations chief, Secretary-General António Guterres, who says, "We cannot construct a future for our grandchildren with a system designed for our grandparents."

Today’s crises and disruptions provide an opportunity to rethink the global financial architecture that influences Africa’s financing for development.

As we come together at the United Nations Headquarters, in New York, to forge a “Pact for the Future,” this opportunity must be leveraged to question the absurd logic that while Africa suffers a large financing gap, it continues to be a net creditor to the rest of the world, with large sums of money leaving the continent each year in the form of illicit financial flows (IFFs) or sovereign wealth funds, pension funds and foreign reserves held in foreign banks outside the continent.

Africa’s development financing challenges

Based on Solving Paradoxes of Africa's Development: Financing, Energy and Food Systems, the UN Office of the Special Adviser on Africa (OSAA)’s 2023 flagship report, Africa loses an estimated $88.6 billion annually in IFFs – 3.7 per cent of its Gross Domestic Product (GDP).

The pension funds outside Africa can be leveraged for infrastructure development and to de-risk long-term investment for the Sustainable Development Goals (SDGs).

OSAA’s report estimates that if African countries could invest 2.8 per cent of their pension fund assets, it would generate $20.9 billion more per year for infrastructure development, reducing the infrastructure financing gap by 30 per cent.

Another major source of leakages is the poor quality of public expenditure in Africa which diverts much-needed resources away from the budget.

The inefficiency of public spending amounted to roughly $12 billion for education, $30 billion for infrastructure and $28 billion for health, representing a combined annual loss of 2.87 per cent of Africa’s GDP.

There is a need to revisit the logic of massive tax incentives extended by African countries ostensibly to attract foreign direct investment (FDI).

OSAA’s paradox report shows that most of these tax expenditures are redundant and costly, depriving governments of important financial resources. For instance, Sub-Saharan African countries experienced forgone revenues of roughly $46 billion in 2019 – or 2.5 per cent of their GDP.

Contrary to the common perception, Africa does not have a liquidity problem. Africa has substantial resources, which, if harnessed effectively, could meet a significant portion of the continent’s development financing needs.

Based on this argument, Africa’s development is already financed, leveraging the continent’s own resources through tax and domestic savings, a source of financing 20 times greater than FDI or nearly 17 times greater than Official Development Assistance (ODA).

The real challenge is mobilizing these resources and channelling them toward financing Africa’s development priorities.

The finance paradox as a game-changer

OSAA’s 2022 flagship report, Financing for Development in the Era of COVID-19: The Primacy of Domestic Resources Mobilisation, reveals several oddities or paradoxes in the current global economic system, including a financing architecture that hampers Africa’s sustainable development.

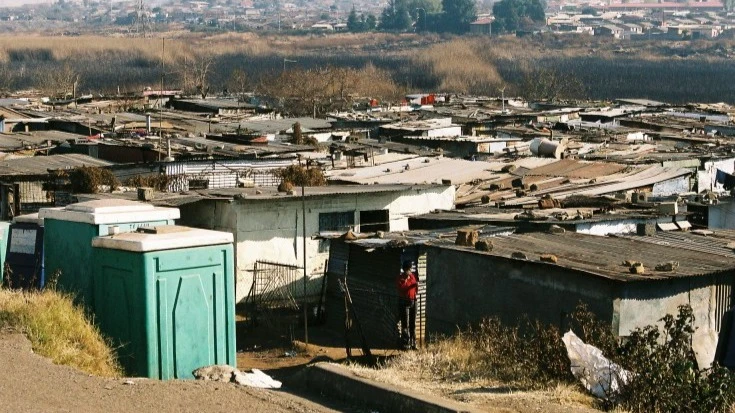

Different models and development frameworks implemented over the years have yielded little to no results, and Africa’s development remains elusive. This path is not sustainable and puts at risk the achievement of the SDGs and the realization of the African Union’s Agenda 2063 aspirations on the continent.

The business-as-usual approach must change. The failure to address these anomalies is at the heart of Africa's liquidity problems and the associated debt stress across the continent. OSAA’s report argues that financing Africa’s momentum requires adopting a different approach and addressing paradoxes.

Africa must understand that blaming and begging are wastes of time. The continent must mobilize to break the triple paradox chain, which is the finance paradox feeding the energy paradox that links to the food systems paradox.

For the first paradox, Africa is in debt distress and captured by debt relief and debt suspensions despite being rich in resources.

For the second, Africa is rich in energy sources but remains a “continent in the dark,” with 600 million people without reliable access to electricity and a huge deficit of industrialization to absorb the 18 million young people who reach the labour market annually despite the emergence of its middle class.

And for the third and last paradox, Africa has vast agricultural resources but faces frequent food insecurity.

The key to breaking this paradox chain is to shift the paradigm of financing for development in Africa and tackle the finance paradox as a game changer.

Relying heavily on external financing, such as ODA, FDI and debt, has proved inadequate. These external sources continue to decline. They are unstable and unpredictable financing resources.

Due to the low revenue base and relatively underdeveloped debt markets, African countries have had to borrow to finance the large financing gap.

This has led to an increase in external debt – currently accounting for an average of 60 per cent of Africa’s public debt and 15.5 per cent of Africa’s exports in 2020, with debt servicing absorbing on average more than 20 per cent of government revenues and reducing the policy space.

Harnessing domestic resource mobilization

Exacerbating the situation is the dominant narrative that Africa's debt distress stems from excessive borrowing and fiscal mismanagement. Such an interpretation overlooks the intricate economic realities of the continent, which are fundamentally tied to structural challenges that extend far beyond the simplistic measure of high debt levels.

In OSAA’s upcoming paper “Challenging Africa’s Debt Narrative,” the fundamental issue is identified as Africa’s lack of control over its economic and financial flows, including illicit financial flows, profit shifting by multinational corporations, unfavourable trade agreements, dependence on commodities, underutilized carbon markets, and untapped pension funds, re-iterating the challenges outlined earlier.

This upcoming paper proposes that "To tackle these challenges, a comprehensive, cross-cutting approach is needed that focuses on strengthening domestic systems, reforming international economic structures and empowering African nations through systemic changes.”

Realizing Africa’s quest for structural transformation and sustainable development requires acquiring and preserving a policy space, which can only be achieved through DRM. Giving primacy to DRM is the only viable way to resolve the paradox of financing for development in Africa.

The continent must break with the past, take ownership of its future, and look within for its own financial development resources.

If all these resources leaking out of Africa are adequately mobilized and plugged into the continent’s development priorities, such as education, health, and infrastructure, this could make a huge difference and significantly reduce its vulnerability to external shocks.

In short, African countries need to mobilize internal resources while promoting cross-border investments.

Robust domestic, regional, and global partnerships are essential for Africa to advance its domestic resource mobilization (DRM) efforts. These partnerships must address global challenges, such as the unfair international tax system and flawed financial architecture, aligning with Africa's development goals.

Improved natural resources management, enhanced fiscal capacity, and better deployment of financial resources are critical steps. Key issues like mispricing, rent-seeking, and ineffective mineral property rights must be resolved, alongside boosting transparency in resource management.

The continent must also strengthen its capacity to control marine resources, combat illegal fishing, and optimize its blue economy.

Tackling tax avoidance, evasion, and illicit financial flows is crucial to building a responsible fiscal culture.

Ultimately, Africa must effectively deploy its financial resources, curbing leakages and prioritizing development-driven investments.

Strategic policymaking for robust country systems

Africa's development potential could be unlocked by mobilizing investment resources to strengthen financial intermediation and build an effective financial system. This system is crucial for fostering a robust indigenous private sector, a key driver of growth for both large, resource-rich and smaller nations.

Over the next decade, African governments face the critical challenge of cultivating a genuine capitalist class. Without it, industrialization and job creation will remain elusive. Agriculture, with Africa’s vast potential, offers a major opportunity.

The private sector must step up to meet Africa’s $30 billion food market and play a role in global value chains. With 50 per cent of the world’s uncultivated arable land, Africa is well-positioned to meet the projected 70 per cent rise in global food demand by 2050, provided policymakers create the necessary infrastructure and institutions.

We must champion an Africa-centric policymaking that prioritizes institution-building and governance and enhances productive capacities to fully integrate into global value chains and drive industrialization.

Our focus should be on creating and managing wealth for Africa, within Africa, by Africans. To our development partners: true progress depends on win-win collaborations centred on transformative agendas.

Development cannot advance if partners simultaneously enable illicit financial flows or use aid to pressure African nations into unfavourable deals.

Together with our international partners, we must embrace a new paradigm that shifts from merely managing poverty to fostering structural transformation.

As we strive for Africa’s accelerated development, let us be guided by Chinua Achebe's words: “While we do our good works, let us not forget that the real solution lies in a world in which charity will have become unnecessary.”

Cristina Duarte is the Under-Secretary-General and Special Adviser of United Nations Secretary-General on Africa.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED