WHY MOST BANKS ARE RELUCTANT TO LEND IN THE AGRICULTURE

Agriculture plays a vital role in Tanzania's economy. According to Statista, it contributed approximately 33.3trn/- around US$13.13 billion to the country’s Gross Domestic Product (GDP) in 2023. In the 2023/24 budget, the agricultural sector accounted for 16.1 percent of the national income, with plans in the 2024/25 budget to increase this contribution to 20 percent. About 68% of Tanzania’s workforce is engaged in agricultural activities, encompassing both rural and urban areas. Notably, 83 percent of these individuals are small-scale farmers, who dominate the sector and contribute around 75 percent of total agricultural output. Given its significance, agriculture demands robust support from all economic stakeholders, particularly banks, which can play a pivotal role in addressing the sector's challenges, fostering growth, and ensuring sustainability.

For a sector that employs 68 percent of the workforce in Tanzania, one might expect financial institutions, particularly banks, to actively support the sector. Yet, the reality tells a different story: credit flow by banks to the agricultural sector remains alarmingly low. Despite substantial growth in Tanzania's banking sector in recent years, banks are not playing an effective role in supporting agriculture. As intermediaries between depositors and borrowers, banks play a crucial role in driving economic progress by channeling resources toward productive activities and eliminating financial inefficiencies.

This intermediary role positions banks as essential drivers of economic progress. However, despite its economic importance, the agricultural sector—which is in desperate need of funding—continues to face significant challenges in securing credit. Banks have been notably hesitant to engage in agricultural financing, and in this article, I will explore some key reasons behind this reluctance.

v High Degree of Informality – One of the primary challenges banks face in lending to the agricultural sector is the high degree of informality. The majority of small farmers and Micro and Small Enterprises (MSEs) in this sector are not formally registered, which creates a multitude of barriers to accessing financial services. These challenges are compounded by low levels of education and financial literacy among farmers, making it difficult for them to navigate financial systems and meet the requirements for loans. Most small farmers do not maintain accounting records, nor can they produce essential financial documents like cash flow statements or balance sheets.

This lack of documentation makes it difficult for banks to assess the creditworthiness of these potential borrowers. Additionally, small-scale farmers often lack tangible assets to pledge as collateral, removing a crucial fallback option for banks in case of loan default. As a result, the high degree of informality has led to widespread financial exclusion for small farmers and agricultural MSEs, preventing them from accessing the capital needed to grow their businesses.

v Political Risks – Agriculture is often considered a strategic sector by governments because it provides employment, sustains livelihoods for a large portion of the population, and serves as a major contributor to GDP through both local consumption and exports. However, its strategic importance also makes it highly susceptible to political risks that deter financial institutions from lending to the sector. Political risks in agriculture typically stem from government intervention and interference. Most countries have experienced some type of political intervention in the agriculture sector and Tanzania is no different.

Also, unpredictable government policies—such as sudden bans on certain crop exports, and changes to subsidies add another layer of uncertainty. These political interventions create unstable pricing of the crops thereby affecting the revenues/cash flow of the farmers. For banks, the combination of cash flow inconsistency, and policy unpredictability makes lending to farmers in politically sensitive sectors a high-risk proposition. This dynamic reduces the availability of much-needed financial assistance to the agricultural sector.

v Price Risks - Agricultural commodities are notoriously subject to price volatility, creating significant uncertainty for farmers. Unlike other sectors, where pricing might be more predictable, farmers typically cannot determine the price of their harvest at the time of planting, when they make key production decisions. One of the primary causes of this volatility is the elastic demand for agricultural products. Even small increases in production can lead to significant price reductions, as supply outpaces demand. Conversely, a drop in production may cause prices to spike. Such price swings make it challenging for farmers to project their earnings accurately, which in turn affects their ability to plan for loan repayments. For financial institutions, this uncertainty translates into unpredictable sales proceeds for farmers, making them appear as high-risk borrowers. Banks often prefer clients with stable and predictable income streams to mitigate risks, and the inherent variability in agricultural income undermines the sector’s attractiveness for lending.

In conclusion, agriculture stands as the cornerstone of Tanzania's economy, significantly contributing to employment, GDP, and national income. Despite its critical importance, the sector remains largely underserved by banks, which have been hesitant to engage actively in agricultural financing. This reluctance stems from several factors, including the sector's high degree of informality, exposure to political risks, and price volatility. Overcoming these barriers calls for a collaborative effort to transform the agricultural ecosystem. With a more structured, transparent, and stable environment, banks will have greater confidence to extend financial support, unlocking the sector's full potential.

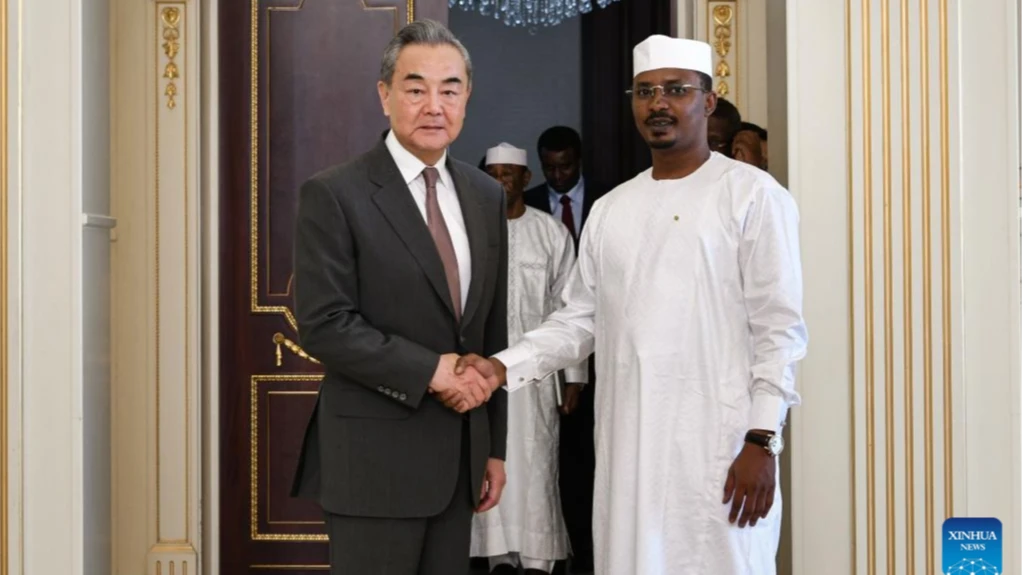

Kelvin Mkwawa, MBA (pictured) is the Seasoned Banker based in Dar es Salaam. He can be contacted through Email address: [email protected]

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED