Stock of foreign private investment hits 54trn/- in 2022

Despite of decreased Foreign Direct Investments in Africa in 2022, the stock of foreign private investment (FPI) in Tanzania, in real time exchange rates, amounted to 54trn/- in 2022, from 48.6trn/ recorded in 2021, the survey conducted by the Bank of Tanzania (BoT) in collaboration with the Tanzania Investment Centre (TIC) and the National Bureau of Statistics (NBS) shows.

FPI comprises Foreign Direct Investment (FDI), Portfolio Investment (PI) and Other Investment (OI).

The increase attributed to continued government initiatives in maintaining and improving the investment climate through the formulation and implementation of investor friendly policies that continue to attract more FDI inflows.

In 2022, the survey report shows that FDI inflows to Tanzania were USD 1,437.6 million, 20.8 percent higher than the inflows recorded in 2021.

This makes Tanzania to be among few African countries that recorded positive high growth in 2022.

Emmanuel Tutuba, Governor, BoT and Chairman of the Executive Committee Private Capital Flows Survey says the increase was attributed to continued initiatives to improve the country’s investment climate including macroeconomic stability, transport, infrastructure, and other legal and regulatory reforms undertaken in Tanzania.

“While the performance of FDI in Tanzania in 2022 shows an upward trend, we envisage to performing better particularly as global economic conditions improve. We promise to advise the governments and do whatever it takes to improve business environment and attract more investors,” the governor commented in the report.

Financing of FDI inflows in 2022 was mainly through reinvestment of earnings, followed by equity and investment fund shares.

“Over time, the two sources have been the major sources of FDI flows to Tanzania, suggesting the existence of investors’ confidence in the country’s investment climate,” the report attributes.

Mining and quarrying, finance and insurance, and manufacturing, continued to attract the largest share of FDI inflows altogether accounting for 88 percent of total inflows in 2022.

Large inflows to the mining and quarrying activity is associated with the expansion of mining activities by large companies while inflows to finance and insurance activities emanated from investment in digital financial services.

According to the report, there was a notable increase in inflows to the mining and quarrying activity, amounting to USD847.1 million compared to US$596.3 million in 2021.

Although there was a decline in manufacturing inflows from USD351.9 million in 2021 to USD180.1 million in 2022, the activity retained its prominence.

Low inflows to manufacturing activity are largely accounted for by a significant decline in profitability reported by firms, reflecting the extent of exposure of this activity to global shocks.

In 2022, reinvestment of earnings from manufacturing activities dropped to USD 147.7 million from USD 783.6 million in 2021.

However, investment in manufacturing activities is expected to grow in 2023, driven by the government's commitment to the industrialization ambition.

This trend suggests investors' optimism about the country’s macroeconomic developments, legal and regulatory frameworks, and political stability; among others.

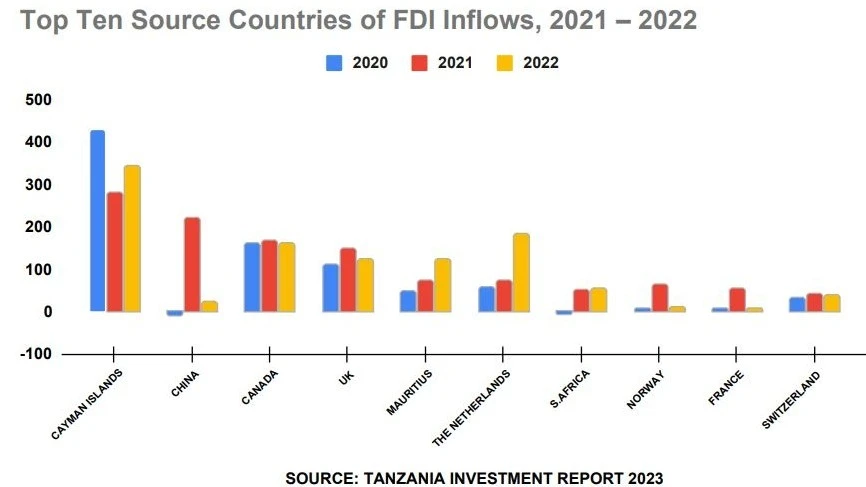

The results show limited diversification of sources of FDI inflows as few countries namely, Cayman Islands, the Netherlands, Canada, and Mauritius continue to dominate the sources of FDI flows.

The five countries accounted for 58.3 percent of FDI sources in 2022.

Inflows of portfolio investment declined to USD 0.2 million in 2022 from USD 4.9 million in 2021. A cyclical trend of portfolio inflows has been observed in previous surveys accounting for the volatility of this type of investment and the infancy of Tanzania's capital market. Further, the share of portfolio investment to total foreign private investments remained less than one percent.

In 2022, the net profit after tax amounted to USD 2,057.3 million which is lower than USD 2,509.6 million in 2021.

Likewise, the dividends declared were USD 460.8 million compared to USD 836.6 million declared in 2021.

Activities that declared the most dividends were consistent with those that attracted more FDI inflows.

The World Investment Report 2023 indicates that FDI inflows to Tanzania have shown significant growth over recent years with its share in Africa increasing by 1.2 percentage points from 2021.

This is notable considering the global economic challenges, reflecting the country’s improvement in the investment climate.

“The prospects for global FDI flows are uncertain amidst a backdrop of economic slowdown, currency fluctuations, and geopolitical tensions,” says the United Nation Conference on Trade and Development (UNCTAD).

The UNCTAD expects the downward pressure on global FDI to continue in 2023.

Factors including rising interest rates, trade disputes, and the lingering effects of the COVID-19 pandemic create challenges for investors.

However, opportunities may arise in activities such as technology, renewable energy, and healthcare, driven by evolving consumer demands and technological advancements.

“The governments' policy responses and efforts to enhance the business friendly environment will play a crucial role in shaping future FDI trends in Tanzania,” it says.

The government has been undertaking major legal and regulatory reforms in a quest to make Tanzania one of the best investment destinations in the continent.

These reforms include tax regime, automation of investment procedures and processes, harmonization of institutions, land laws as well as unlocking hurdles that impede business growth.

Tanzania's economy has exhibited strong performance despite global shocks, thus making it an attractive destination for investors seeking stability and growth opportunities.

Tanzania has abundant investment opportunities across a broad spectrum of activities, mostly in agriculture, mining, tourism, manufacturing, agro-processing, pharmaceuticals, real estate, livestock, and the blue economy.

The government is dedicated to enhancing the investment climate and developing mega infrastructure to attract both foreign and domestic investments.

Through ongoing legal and regulatory reforms highlighted in the Blueprint for regulatory reforms to improve the business environment, Tanzania is positioned to become a prime investment destination in Africa, fostering social and economic prosperity for its citizens.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED