NMB records 687bn/-pre-tax profit in Jan-Sep 2024

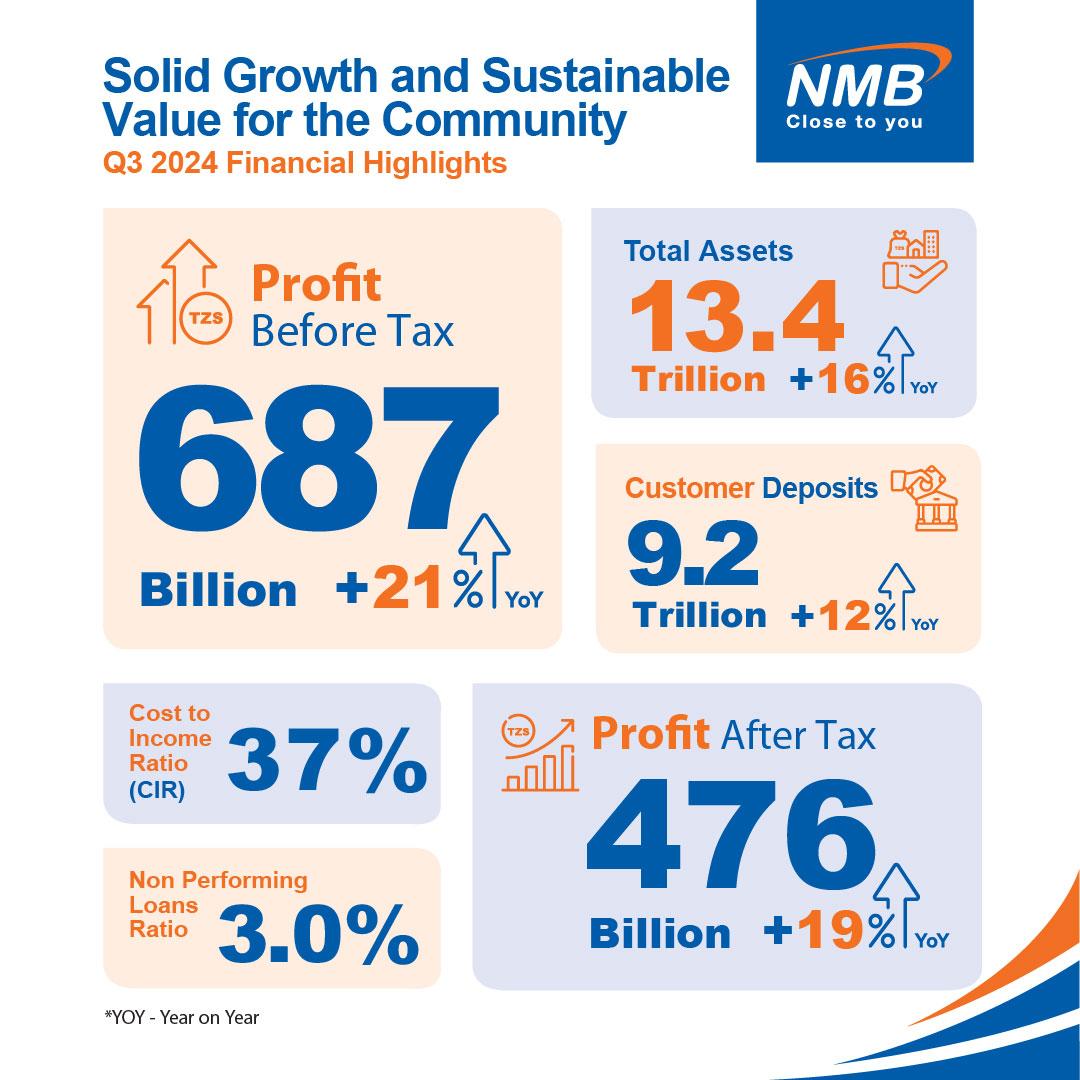

NMB Bank has announced strong results for the period ended September 30, 2024, posting a remarkable 21 percent year-on-year (YoY) increase in profit before tax to 687bn/- compared to 569bn/- recorded the same period last year.

Showcasing substantial progress in the execution of the Bank’s core strategy, this historic performance marks yet another important milestone in the history of NMB Bank and the Tanzania banking sector. During the reporting period, the Bank recorded a Profit After Tax of 476bn/- (up 19% YoY) from 398bn/- in the corresponding period of 2023.

The bank’s strong performance was primarily driven by solid business momentum, enhanced efficiency gains, and significant improvements in loan portfolio quality.

With a cost-to-income ratio (CIR) of 37 percent, compared to 38 percent in the same period in 2023, the bank's efficiency ratio further improved and remained well within the regulatory benchmark of 55 percent. Moving forward, NMB Bank will continue enhancing efficiency while maintaining a strong focus on strategic investments aimed at achieving continuous service and operational excellence.

Credit quality continued to improve, driven by a strong emphasis on quality credit origination and prudent risk management of the credit portfolio. As a result, the Bank’s non-performing loan (NPL) ratio remained comfortably below the 5 percent regulatory benchmark, closing Q3 at 3 percent, a significant improvement from 3.8 percent in the same period last year.

The Bank maintained strong revenue performance during the period, with cumulative net interest income (NII) rising to 779bn/-, up from 692bn/-at the end of September 2023. Cumulative non-funded income (NFI) reached 430bn/-in Q3 2024, compared to 334bn/-in the same period last year.

The strong growth in NII and NFI was driven by robust balance sheet expansion and a significant increase in client activities, reflecting the positive impact of the Bank’s accelerated investments in new technologies and innovative capabilities.

With our balance sheet remaining a source of strength, total assets soared to 13.4trn/- at the end of Q3, representing a 16 percent year-on-year (YoY) increase. This growth was primarily driven by the Bank’s expanding deposit base, which rose by 12 percent to 9.2trn/-, and the loan book that increased by 19 percent to 8.4trn/-."

Ruth Zaipuna, NMB Bank CEO noted: ‘‘The bank’s strong performance is a further testament to the resilience of the bank’s business model, disciplined execution of bank’s strategy, and the strength of stakeholders trust unto the bank’’.

“We maintain an optimistic outlook as we move towards the end of the year, supported by a favourable policy and business environment. We will continue to invest in technology and innovative solutions, as well as in our communities and our people. We remain ever so committed to unlocking further opportunities for sustainable value creation for all our stakeholders.”

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED