More Regions with GDP per capital below national average

The number of regions with a GDP per capita below the national average, at current market prices, continues to increase, highlighting the growing economic disparities across the country.

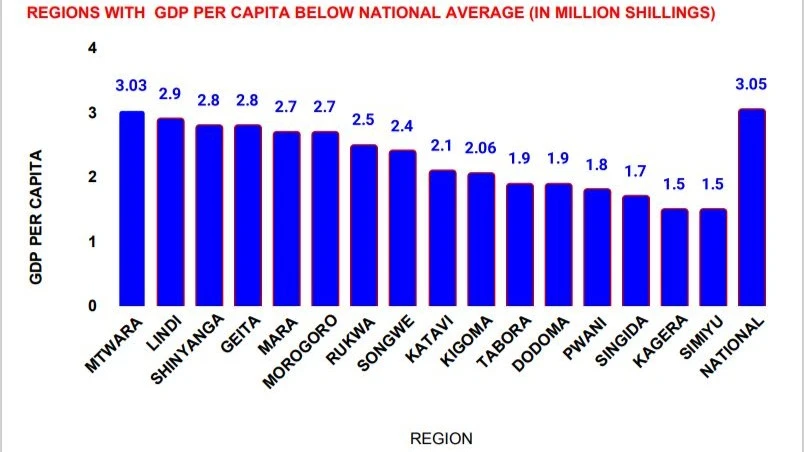

According to the latest revised data (2019-2022) and provisional figures for 2023 released recently by the Bank of Tanzania (BoT), by 2023, 16 out of 26 regions had a GDP per capita below the national average of 3,058,847/-, up from 15 regions in 2022.

Between 2017 and 2021, only 12 Tanzania mainland regions recorded a GDP per capita below the national average.

The 16 regions with the lowest GDP per capita include Mtwara, Lindi, Shinyanga, Geita, Mara, Morogoro, Rukwa, Songwe, Katavi, Kigoma, Tabora, Dodoma, Pwani, Singida, Kagera, and Simiyu.

Analysts attribute these gaps to factors such as rising population, as indicated by the 2022 Population and Census report, as well as varying levels of investments, infrastructure development, and industrial activity.

Regions with strong economic activity, particularly those with thriving mining, industries, or tourism sectors—including Dar es Salaam, Iringa, Mbeya, Kilimanjaro, Njombe, Arusha, Mwanza, Manyara, and Tanga—continue to lead in GDP per capita, surpassing the national average.

Notably, four regions that were above the national average from 2017 to 2020—Geita, Shinyanga, Lindi, and Mtwara—dropped below it by 2023.

Economists stress that reducing these disparities requires policies focused on population management, infrastructure enhancement, investment incentives, and industry support.

Regional governments are also urged to collaborate with national stakeholders to boost economic activities that can spur job creation and raise household incomes.

The central government is also encouraged to support underperforming regions with funding for improving infrastructure, education, and healthcare to stimulate local economies.

Infrastructure development remains uneven, with regions like Dar es Salaam, Arusha, and Mwanza having better access to roads, ports, and telecommunications, attracting more business activities and investments.

In contrast, remote regions such as Kigoma, Lindi, Katavi and Rukwa are struggling with inadequate infrastructure, limiting economic opportunities and access to markets, healthcare, and education services.

The concentration of industrial and service sectors in regions like Dar es Salaam, the country’s economic hub, fosters better job opportunities and higher incomes. Manufacturing, financial services, and trade are predominantly urban, while regions without significant industrial activity face limited employment prospects, perpetuating poverty.

The 2022 Population and Census Report further reveals that eight of the 16 regions with GDP per capita below the national average, including Simiyu, Tabora, Katavi, Kigoma, Mara, Geita, and Singida, also recorded the highest dependency ratios, ranging from 106.1 to 119.3, well above the national average of 87.4.

Meanwhile, according to 2022 census, regions with low GDP per capita, such as Simiyu, Pwani, Katavi, Tabora, Dodoma, Singida, Rukwa, Shinyanga, and Geita, recorded high population growth rates of 3.7 to 7.1 percent between 2012 and 2022, surpassing the national average of 3.2 percent for mainland Tanzania.

Economists urge that Tanzania’s rapid population growth poses significant challenges to sustainable development, infrastructure, and social services. With an annual growth rate of around 3 percent, the population is projected to double within the next few decades, increasing demand for resources like food, water, and energy.

Education is a key area impacted by this growth, as a growing population demands more schools, teachers, and materials.

Despite government efforts, maintaining quality education while expanding access remains challenging. Overcrowded classrooms and a shortage of trained teachers affect learning outcomes, particularly in rural areas.

Healthcare services are similarly strained, with increasing demand for hospitals, clinics, and medical personnel.

High population growth exacerbates issues related to child and maternal health, malnutrition, and disease management. Urban areas, in particular, experience long wait times, shortages of essential medicines, and under-resourced facilities due to rising demand.

Employment remains another major challenge. With over 60 percent of Tanzania’s population under the age of 25, the need for job opportunities is acute.

However, the formal sector has struggled to keep pace, leading to high youth unemployment and underemployment. Many young people resort to informal or low-paying jobs, limiting economic mobility and increasing vulnerability to poverty.

By prioritizing infrastructure development, enhancing agricultural productivity, promoting local industries, and investing in human capital, Tanzania can bridge regional disparities and promote balanced economic development.

Addressing these challenges is crucial for poverty reduction and long-term social and economic stability.

The BoT provisional data show that the national Gross Domestic Product (GDP), at current market prices, increased to 188.7trn/- in 2023, from 170.8trn/- recorded in 2022.

Dar es Salaam continue to hold its position as the largest economy with an estimated 32trn/-, followed by Mwanza region with 13.5trn/- while Mbeya and Morogoro are the third and fourth largest with GDPs of 9trn/- and 8.8trn/- respectively.

The smallest economies in Tanzania mainland include Katav, with the GDP of 2.5trn/- followed by Simuyu (3.41trn), Songwe (3.42trn/-), Njombe (3.43trn/-), Singida (3.5trn/-), Lindo (3.6trn/-, Pwani (3.8trn/-) Rukwa (3.9trn/-) and Kagera with the regional GDP of 4.8trn/-.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED