Mobile money accounts hit 55mln with slight change of market share

MOBILE money has continued to expand financial inclusion, as number of accounts increased to 55.7 million by the end of June this year from 47.2 million recorded at the end of June last year, with little change of market share.

The trend of mobile money transactions have also increased by 2.3 billion to 5.3 billion at the end of June this year, from 3 billion in 2019, representing a 19 percent of annual growth rate, which shows increased public confidence as secure, fast and reliable financial transactions platform.

Mobile money is currently dependable by most of the population and businesses in both rural and urban areas for savings, utilities bill payment, sending and receiving cash, borrowing and other making other payments.

Beyond improving financial inclusion and access to other digitally enabled services, the adoption, use and growth of mobile money are now reflected in macroeconomic indicators, specifically GDP.

During the last five years, the report shows that average transactions per mobile money subscribers decreased from 117 in 2019 to 100 in 2024.

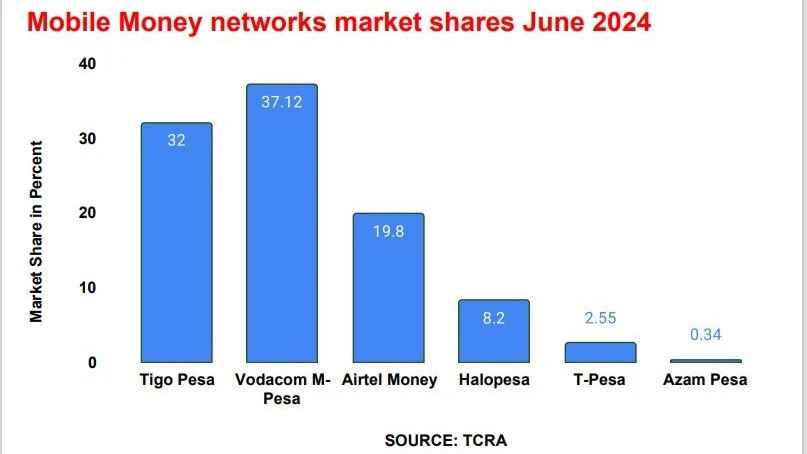

The latest report by the Tanzania Communication Regulatory Authority (TCRA) show three Mobile Money Operators (MNOs) including Vodacom, Tigo and Airtel continue to dominate the market with around 89 percent of market share by subscription, which indicate highly competitive market.

The report shows Vodacom is still leading with the largest market share of 37.12 percent at the end of June this year, with 20.6 million subscribers, an increase from 17.1 million or 36 percent recorded at the end of June last year.

Tigo Pesa is the second largest with 17.8 million subscribers or 32 percent of the market share, an increase from 14.8 million or 31 percent in June 2023.

However, despite of being the third largest, Airtel Money lost its market share to 19.8 percent at the end of June this year, compared to 22 percent in June 2023, amid slight increase of its subscription to 11 million from 10 percent respectively.

Top gainer during the period was Azam Pesa, the new entrant in the market, after its number of subscribers more than tripled in only three months to 187,691 at the end of June this year from 53,560 recorded at the end of April this year.

The sharp growth of Azam Pesa subscribers has enabled the infant company to uptake 0.34 percent of the mobile money market share at the end of June this year.

The report shows HaloPesa is the fourth largest with 8.2 percent of market share, a slight increase from 8 percent at the end of June last year, while number of subscribers went up to 4.5 million from 3.7 million respectively.

The market share of the state-owned T-Pesa slightly declined to 2.55 percent from 3 percent, amid an increased number of subscribers to 1.4 million, compared with 1.2 million.

The Tanzania mobile money market size reached $ 70.9 Billion in 2023, and looking forward, IMARC Group expects the market to reach US$ 211.7 Billion by 2032, exhibiting a growth rate (CAGR) of 12.5 percent during 2024-2032.

The Fin Scope Tanzania 2023 report by Financial Sector Deepening Trust (FSDT) indicates that the adoption of mobile money increased to 72 percent in 2023, compared to 60 percent in 2017, boosting the formal financial services to Tanzania.

“While mobile money has already become an integral part of many Tanzanians’ daily lives for peer-to-peer transfers, there remains a significant untapped potential,” said Julia Seifert, Research and Insights Consultant – FSDT.

“To boost mobile money adoption and usage even further, there’s a need is to focus on its use cases, with a prime example being the exclusive use of mobile money for purchasing airtime voucher and bundles.”

Seifert comments that, airtime, crucial for communication in the digital age, represents a prime opportunity to drive further adoption and usage of mobile money services.

Surprisingly, only 23 percent adult Tanzanians purchase airtime using mobile money, the consultant says, noting that regulatory support is critical for creating an enabling environment for mobile money adoption.

“Policymakers can play a significant role in promoting competition, innovation, and consumer protection within the mobile money ecosystem,” the consultant says. “By implementing supportive policies and regulations, regulators can foster trust and confidence among consumers and businesses, driving further adoption.”

As the rapid expansion of mobile money accounts eases, the industry is beginning to show signs of maturity that reflect its natural evolution over time.

“Today, more money and more transactions flow through mobile wallets than ever before, bringing a range of financial products into the hands of hundreds of millions of users and disrupting traditional financial services,” says the GSMA’s state of the industry report on mobile money 2024.

For over two decades mobile money services have grown exponentially, driving financial inclusion for billions of people, opening up incredible opportunities for entrepreneurs and small businesses across the world.

According to GSMA, a total of 1.75 billion registered accounts today are processing $1.4 trillion a year, or about $2.7 million a minute.

Sub-Saharan Africa, including Tanzania, has been a key driver of mobile money’s success, home to almost three-quarters of the world’s accounts.

“In the 10 years to 2022, mobile money contributed $600 billion to the GDP of countries with a mobile money service,” the report says.

International remittances are now one of the fastest growing use cases of mobile money, while merchant payments expanded by 14 percent to almost $74 billion in 2023.

Mobile money also remains a leading driver of the United Nations Sustainable Development Goals (SDGs), contributing to 15 of the 17 goals, including SDG 11 (Sustainable cities and communities) and SDG 12 (Responsible consumption and production).

“As mobile money continues to grow and evolve, it opens up even more opportunities for citizens, businesses and economies across the world,” says Mats Granryd Director General, GSMA.

Mobile money providers are also working with banks whereby a customer can transact cash from the bank account to mobile money and vice versa or receive money from banks.

Collectively, bank-to-mobile and mobile-to-bank transactions grew by 15 percent year-on-year to $210 billion in 2023.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED

![The CEO of Flightlink Limited Mr. Munawer Dhirani and DTB Tanzania CEO, Mr. Ravneet Chowdhury [center] during the unveiling ceremony of the 72-seater ATR 500 aircraft over the weekend. Other officials present at the function are Chief Operating Officer.](https://ippmedia.com/storage/post-feature-images/01J75Y6DM8PY93SGFZD4GYPXJ4.webp )