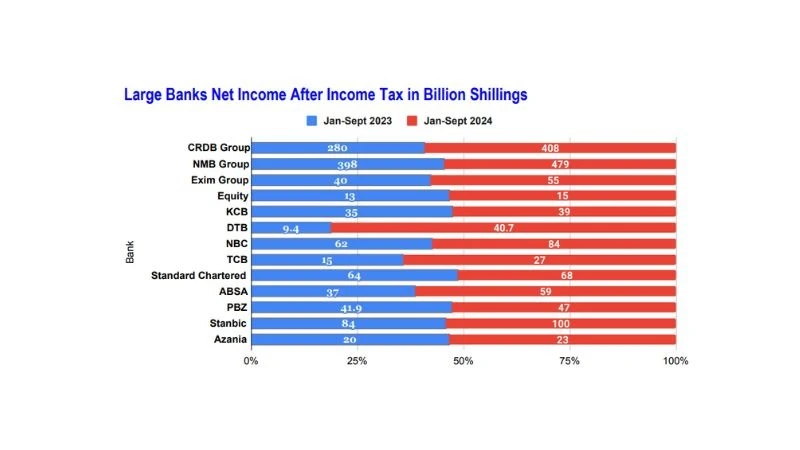

Large banks record strong growth of profitability for three quarters

The first three quarters of 2024 marked substantial growth for Tanzania’s largest banks, showcasing a resilient banking sector driven by increased assets, deposits, and profitability.

This trend underscores strong economic fundamentals and solid banking sector stability within the country, with several banks experiencing notable advancements in both income and assets growth while maintaining healthy loan and deposit balances.

In its Monetary Policy Report for October, the Bank of Tanzania (BoT said the banking sector, which constitutes more than 70 percent of the financial sector, was liquid and adequately capitalized, indicating the ability to extend credit to the private sector.

“Banks’ deposits and loans increased, attributable to agent-banking services, financial products, and digital banking services. The expansion of loans was attributable to the improved business environment, a decline in non-performing loans from 5.1 percent in 2023 to 3.9 percent in August 2024, and an increase in demand for credit in line with economic growth,” the report said.

According to the unaudited financial statements for the third quarter CRDB Group, the largest financial institution in terms of assets, reported a significant rise in its net income, reaching 408bn/- in nine months, up from 280bn/- in nine months of previous year.

Net interest income increased from 609bn/- to 805bn/-.

The bank’s total assets grew from 15.08trn/- in Q2, 2024 to 16.04trn/- by Q3.

Loans rose from 9.49trn/- at the end of June 2004 to 10.09trn/- at the end of September, and customer deposits saw a marginal increase from 9.9trn/- to 10.14trn/-, with total deposits reaching 10.3trn/-, up from 8.7trn/- in Q3 2023.

Shareholder funds also showed an increase, standing at 2.04trn/-, compared to 1.9trn/- recorded during the end of the second quarter of this year.

Azania Bank's net profit increased to 23bn/- during the first nine months of this year from 20bn/- recorded during a similar period of last year.

Unaudited financial statements show the bank also managed to increase its total assets to 2.33trn/- during the third quarter of this year from 2.30trn/- during the second quarter.

Lending slightly increased to 1.78trn/- from 1.73trn/- while customer deposits amounted to 1.6trn/- at the end of September this year.

Total shareholders’ fund increased to 315bn/- at the end of September this year from 307bn/- recorded at the end of June this year, driven by increased profit account, amid a slowdown of retained earnings.

NMB Bank, the most profitable and second largest in terms of assets saw its total assets rise from 12.9trn/- in Q2 to 13.4trn/- in Q3, while customer deposits climbed from 8.8trn/- to 9trn/-.

The bank's net income increased to 476bn/- during the first three quarters of this year from 398bn/-, driven by a 19 percent growth in interest income, from 691bn/- to 778bn/-. Shareholder funds also grew slightly from 2.2trn/- to 2.3trn/-.

Diamond Trust Bank (DTB) recorded substantial profit growth, with net income leaping from 9.4bn/- during the first three quarters of last year to 40.7bn/- during a similar period of this year, while net interest income rose from 67bn/- to 86bn/-.

However, DTB’s total assets saw a small increase from 1.83trn/- in the second quarter of this year to 1.85trn/ during the end of the third quarter.

Customer deposits, however, fell slightly from 1.5trn/- to 1.4trn/-. The bank’s shareholders’ funds increased from 262bn/- to 285bn/-, and earnings per share surged from 2,555/- to 37,448/-.

KCB Bank reported an increase in total assets from 1.3trn/- in Q3 2023 to 1.5trn/- in Q3 2024, with quarterly growth to 1.53trn/-.

Operating income rose significantly from 39.5bn/- to 57.7bn/-, while net income went up from 35bn/- to 39bn/-. Shareholder funds increased from 176.5bn/- to 209bn/-.

Loans expanded from 836bn/- in Q3 2023 to 995bn/- in Q3 2024, and customer deposits grew from 806bn/- to 1.01trn/-.

NBC, the third largest bank in terms of assets, maintained stable total assets at 4.1trn/-. Loans increased marginally from 2.78trn/- to 2.86trn/- , while customer deposits inched up from 2.75trn/- to 2.79trn/- .

The bank’s net income grew to 84bn/- from 62bn/-, while shareholder funds rose to 464bn/- from 437bn/-.

TCB’s total assets rose from 1.4trn/- to 1.6trn/-. Customer deposits also saw a slight increase from 1.06trn/- to 1.08trn/-, and loans advanced from 1.01trn/- to 1.07trn/-.

The bank’s net income nearly doubled from 15.1bn/- to 27.3bn/-, driven by an increase in net interest income from 74.7bn/- to 94.5bn/-.

Standard Chartered Bank experienced modest asset growth, with total assets rising from 2.31trn/- to 2.36trn/-. Customer deposits remained stable at 1.4trn/-, while shareholder funds increased from 424bn/- to 436bn/-.

Net income grew from 64bn/- to 68bn/-, with net interest income ticking up slightly from 83.7bn/- to 85.8bn/-.

Absa recorded growth in total assets from 1.59trn/- to 1.61trn/-, with customer deposits rising from 1.17trn/- to 1.19trn/-.

Net income jumped significantly from 37.7bn/- to 59bn/-, as net interest income grew from 69bn/- to 82bn/-. Loan levels held steady at around 850bn/-, and non-performing loans (NPLs) declined from 4.4 percent to 1.5 percent.

PBZ’s total assets rose from 2.2trn/- to 2.4trn/-, with customer deposits increasing from 1.75trn/- to 1.99trn/-. Loans expanded slightly from 1.1trn/- to 1.2trn/-, with NPLs decreasing from 2.44 percent to 2.06 percent.

The bank’s net income rose from 41.9bn/- to 47.2bn/-, with total shareholder funds growing from 223bn/- to 232bn/-.

Exim Bank maintained total assets of 3.1trn/-, with loans rising from 1.6trn/- to 1.7trn/-. Customer deposits rose from 2.41trn/- to 2.46trn/-. Net income increased from 40.9 bn/- to 55.8bn/-, with net interest income growing from 105bn/- to 129bn/-.

Profit before tax surged by 33.4 percent year-over-year to 87.8bn/-.

Stanbic Bank’s total assets increased from 2.7trn/- to 2.9trn/-, with customer deposits slightly up from 1.8trn/- to 1.85trn/-.

The bank’s loan portfolio rose from 1.54trn/- to 1.55trn/-, while net income increased from 84.9bn/- to 100.6bn/-. Shareholder funds remained steady at 490-495bn/-.

Equity Bank’s total assets were largely unchanged at around 1trn/-. Customer deposits dropped from 761bn/- to 733bn/-, while loans and overdrafts decreased from 536bn/- to 516bn/-.

Despite the decline in deposits, Equity Bank’s net income rose slightly from 13bn/- during the first nine months of last year to 15bn/- during the first nine months of this year, and net interest income increased from 34.8bn/- to 42.2bn/- respectively.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED