Farmers to benefit from CRDB’s digital financial solutions

In a bold move to revolutionize financial access for Tanzania’s agricultural sector, CRDB Bank has joined the Mobilizing Access to the Digital Economy (MADE) Alliance: Africa, an initiative led by Mastercard and the African Development Bank (AfDB).

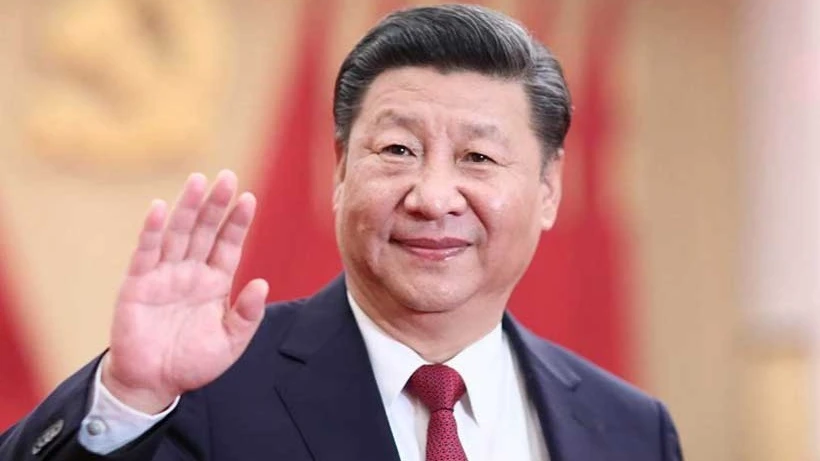

Speaking at the bank’s head office in Dar es Salaam yesterday, Abdulmajid Nsekela (pictured), CRDB Bank Group CEO emphasized that the bank’s participation in the MADE Alliance Africa aims to connect millions of Tanzanian farmers to digital financial services.

Formally, the CRDB Bank’s commitment to the MADE Alliance Tanzania Chapter was officially announced during the 79th United Nations General Assembly (UNGA) in New York.

Through its FahariKilimo account, the Bank offers farmers essential benefits such as digital payments, savings, insurance, and access to credit—empowering them to optimize their agricultural operations.

The bank currently accounts for 60 percent of Tanzania’s agricultural financing, making it a crucial player in the sector.

“Our involvement in the MADE Alliance Africa aligns with our mission to empower farmers through digital platforms,” said Nsekela. “We are committed to equipping farmers with the tools they need to modernize their practices, access affordable credit, and build resilience against climate change. Our digital solutions, such as SimBanking and the CRDB Wakala agent network, bring financial services closer to farmers, enabling them to save, borrow, and insure their crops with ease.”

Nsekela also highlighted the Bank’s ongoing efforts to digitize farming communities, offering services such as agricultural input loans, farm mechanization loans, the Outgrower’s Loan Scheme, Warehouse Construction Loan, and Warehouse Receipt Financing.

Additionally, the bank collaborates with the National Health Insurance Fund (NHIF) to offer health insurance and, through its subsidiary CRDB Bank Insurance, provides crop insurance against risks such as drought and floods, ensuring comprehensive support for farmers’ financial security.

In a broader effort to promote financial inclusion, the bank is extending its reach through the IMBEJU Kilimo program, which operates under the CRDB Bank Foundation.

“Digitizing agricultural finance is key to advancing modern farming practices in Tanzania,” Nsekela added.

"Through the IMBEJU Kilimo program, we are empowering small-scale farmers with financial literacy, digital finance solutions, and seed capital. These initiatives not only increase their access to modern farming techniques but also widen digital financial inclusion, ensuring that no farmer is left behind."

CRDB Bank is also the only bank in Tanzania fully committed to capacitating farmers through extensive training programs.

Under its Foundation, the bank provides farmers with essential training in digital literacy, financial management, and climate adaptation strategies—ensuring they have the knowledge and tools necessary to thrive in the modern economy.

As an accredited partner of the United Nations Green Climate Fund (UNGCF), the bank also assists farmers in adopting climate-resilient practices and technologies. Through initiatives like the TACATDP program, the Bank promotes advanced solutions such as irrigation systems, precision agriculture, and solar-powered machinery, which mitigate climate risks and enhance yields.

Speaking during a virtual conference, Mastercard’s Vice Chair and President of Strategic Growth, Ambassador Jon Hauntsman, expressed his enthusiasm for CRDB Bank’s involvement in the MADE Alliance Africa.

He stated, “CRDB Bank’s extensive experience and strong commitment to agricultural financing make them a key partner in this mission. We are excited to collaborate with them to develop and implement innovative digital solutions that will empower millions of farmers across Tanzania. Their expertise in integrating financial services with advanced technology, along with their deep-rooted engagement in the farming community, aligns perfectly with the goals of the MADE Alliance.”

CRDB Bank’s participation in the MADE Alliance Africa strengthens its position as a leader in modernizing Tanzania’s agricultural sector.

By providing farmers with the tools and support they need to succeed, the future looks promising for Tanzania’s farmers, who remain at the heart of the country’s economic transformation.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED