Dr Mkuya urges public firms to remit govt dividends

The Zanzibar’s Minister of State-President's Office (Finance and Planning) Dr Saada Mkuya Salum has urged public institutions to fulfill their duty of remitting dividends to the government.

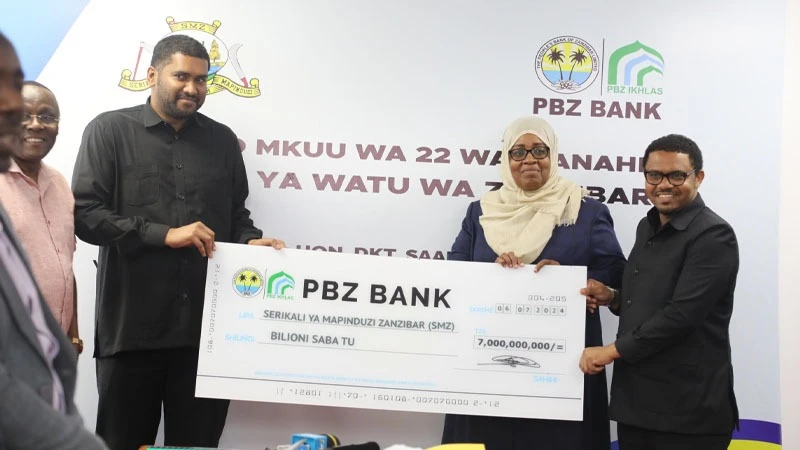

Dr Mkuya made the call here over the weekend when receiving on behalf of the government 7bn/- as dividends from the People's Bank of Zanzibar (PBZ), which is fully government owned.

The payout comes on the heels of the bank's impressive performance in 2023.

Dr. Mkuya asked other public entities to inculcate a habit of paying back what is required to be paid to the government as stipulated in the law.

"The government is pleased with the ongoing success you are achieving, and our emphasis to you is to continue operating efficiently and professionally. As shareholders, we are happy to see our investment bearing fruit. The 7bn/- dividend received by the government today will increase the size of our revenue pool, which has been directed towards various development projects, especially strategic ones," said Dr. Mkuya.

Joseph Meza, chairman of the PBZ Board of Directors, expressed the bank's delight in presenting the substantial dividend, stating that the success and positive trend confirm the high trust customers have placed in the institution.

“We are happy to remain committed to achieving our important goals in expanding our footprint and investing in technology to enhance our customers' experience. Today, we are delighted to present a dummy cheque worth 7bn/- as a dividend for the year 2023. We look forward to a more hopeful future while continuing to provide better services to our customers,” said Meza.

Arafat Haji, PBZ managing director acknowledged the government's role in creating a conducive environment for financial institutions to thrive, and he commended the bank's board and employees for their exceptional efforts in driving this remarkable performance.

"The bank's performance demonstrates a conducive business environment that has allowed us to reach our customers easily. We will continue to invest in technology, expand our footprint, and improve our services to meet and exceed the expectations of our customers," said Haji.

In the year 2023, PBZ Bank successfully increased its pre-tax profits to 74 billion shillings, with its asset base reaching 2.05trn/-. The bank, which currently operates 33 branches, is strategizing to open more branches in various regions of the country, with recent expansions in Morogoro and Mbeya regions.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED