BoT to usher in online complaints filing system mid-January 2025

THE Bank of Tanzania (BoT) is set to introduce an online financial complaints resolution system (FCRS) mid-January 2025 targeting making it easy for financial services consumers to deliver their complaints directly to the central bank.

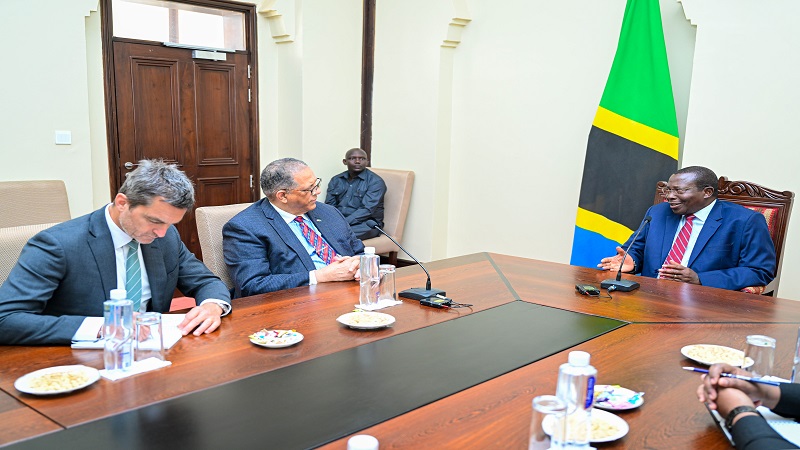

Addressing stakeholders from the financial sector yesterday in Dar es Salaam Dr Khadijah Kishimba said that the system has already been developed and the central bank had decided to take them through the system features before it’s brought into effect.

Dr Kishimba said that BoT through a two-day workshop to financial services providers targeted at preparing and revealing the system’s features to stakeholders such as bankers, insurers and microfinance institutions executives before it is brought into effect.

She said financial services consumers are required first to file their complaints to their service providers and if unsatisfied with the offered solutions are allowed to file the complaints directly to BoT with attached evidence of previous initiatives on settling the matter.

According to her, in fulfilling the goal of financial inclusion confidence creation among service consumers is essential especially when it comes to handling consumer complaints.

She asserted that complaints are now being received in the central bank’s branches or in the complaint desks in the respective banks, which is a matter of concern for many consumers.

"We felt the need for a system that will enable consumers to submit their complaints in a simpler way. The system has been designed by the central bank in collaboration with the e-Government Authority," said Dr Kishimba.

According to her, BoT issued the Financial Consumer Protection Regulations, 2019 to guide financial services providers (FSPs) to have in place the effective complaints handling mechanism to resolve customer complaints.

Further, the regulations prohibit FSPs from engaging in unfair or deceptive market practices.

Violet Luhanjo, BoT’s Assistant Manager Complaints Resolution Division said that one of the central bank’s objectives of developing the system is to offer timely resolutions of financial complaints.

“Other objectives are to empower consumers in exercising their rights and access to adequate, timely, and efficient redress for their complaints and for easy management of complaint records,” said Luhanjo.

According to her, some features of the system include development of a portal for submission of complaints, FSPs portal which covers notice of response, extension of time and file review.

She mentioned other features as complaints status; and complaint processing which requires confirmation of complaints eligibility, request for more information, digital signature, team management; and processing timeline.

Elizabeth Mhina, NMB Plc Customer Experience Manager said that financial services providers as key stakeholders have been consulted and engaged in all processes of developing the system.

“The integration of the system between financial service providers and the central bank will add more confidence to financial services consumers. Most frequent complaints from customers are related to money theft through ATM machines and loss of ATM cards,” said Mhina.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED