BOT: financial services to reach 80pc of Tanzanians by 2028

The government, through the Bank of Tanzania (BOT), aims to ensure that integrated financial services reach 80 percent of citizens by the year 2028.

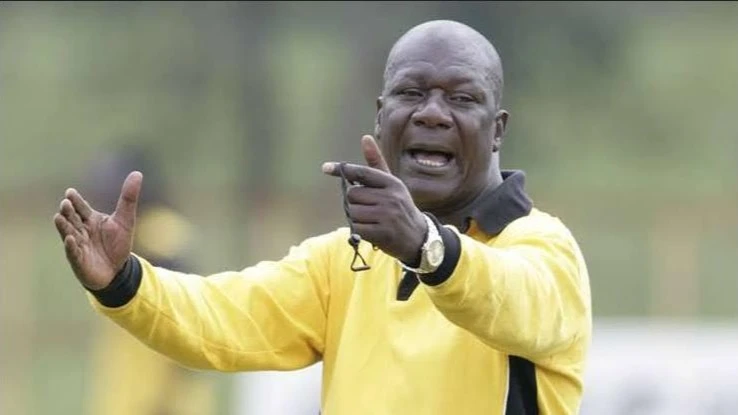

At the launch of Access Tanzania Bank, Deputy Governor of BOT Sauda Kassim Msemo (pictured) stated that currently, financial services have reached 76 percent of the population, while banking services are at 22 percent.

She emphasized that financial inclusion is vital for fostering sustainable economic growth in Tanzania.

"The government continues to create a conducive investment environment. The central bank is committed to ensuring that loans to the private sector, especially in agriculture, are accessible through various sponsors to stimulate investment and enhance our economy," said Sauda.

She also noted that BOT has eased the conditions for agents providing financial services, aiming to expand access for the majority of Tanzanians.

The rise of mobile banking services has played a crucial role in expanding financial access, especially in rural areas. Mobile money platforms have made it easier for individuals to conduct transactions, save, and access credit.

The Tanzanian government has implemented various strategies to enhance financial inclusion. The National Financial Inclusion Framework aims to ensure that financial services are accessible to all citizens, particularly the underserved segments of the population.

Continued investment in fintech solutions is expected to drive further improvements in financial access. By leveraging technology, financial institutions can offer innovative products tailored to the needs of diverse populations.

"In launching Access Tanzania Bank, I encourage you to enhance creativity in your service delivery and focus on digital platforms and technology, as the world is moving in that direction," she added.

Deputy Minister of Information, Communications, and Information Technology Engineer Maryprisca Mahundi, speaking on behalf of the Deputy Minister of Finance Hamad Chande, highlighted that the bank's launch demonstrates the resilience of the Tanzanian economy.

"The government will continue to cooperate with all investors and support their efforts. I urge the bank to ensure that your financial services reach citizens in remote regions," said Maryprisca.

Imani John, the bank's CEO, announced that the bank was established following the acquisition of BancABC Tanzania.

"This marks the beginning of providing better services and boosting the economic growth of our country, while also creating opportunities for businesses and citizens," he said.

He added that plans are in place to ensure services are available in rural areas, thus expanding opportunities for all citizens.

Janeth Lekashingo, a member of the bank's Board of Directors, expressed gratitude to President Samia for fostering a favorable business and investment environment that facilitated the bank's establishment.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED