Banks urged to enhance inclusive insurance

THE Tanzania Insurance Regulatory Authority (TIRA) has called on the country’s financial institutions to continue working closely with various insurance companies to collectively facilitate the accessibility of the vital service, as well as develop better marketing strategies to reach citizens and meet their needs.

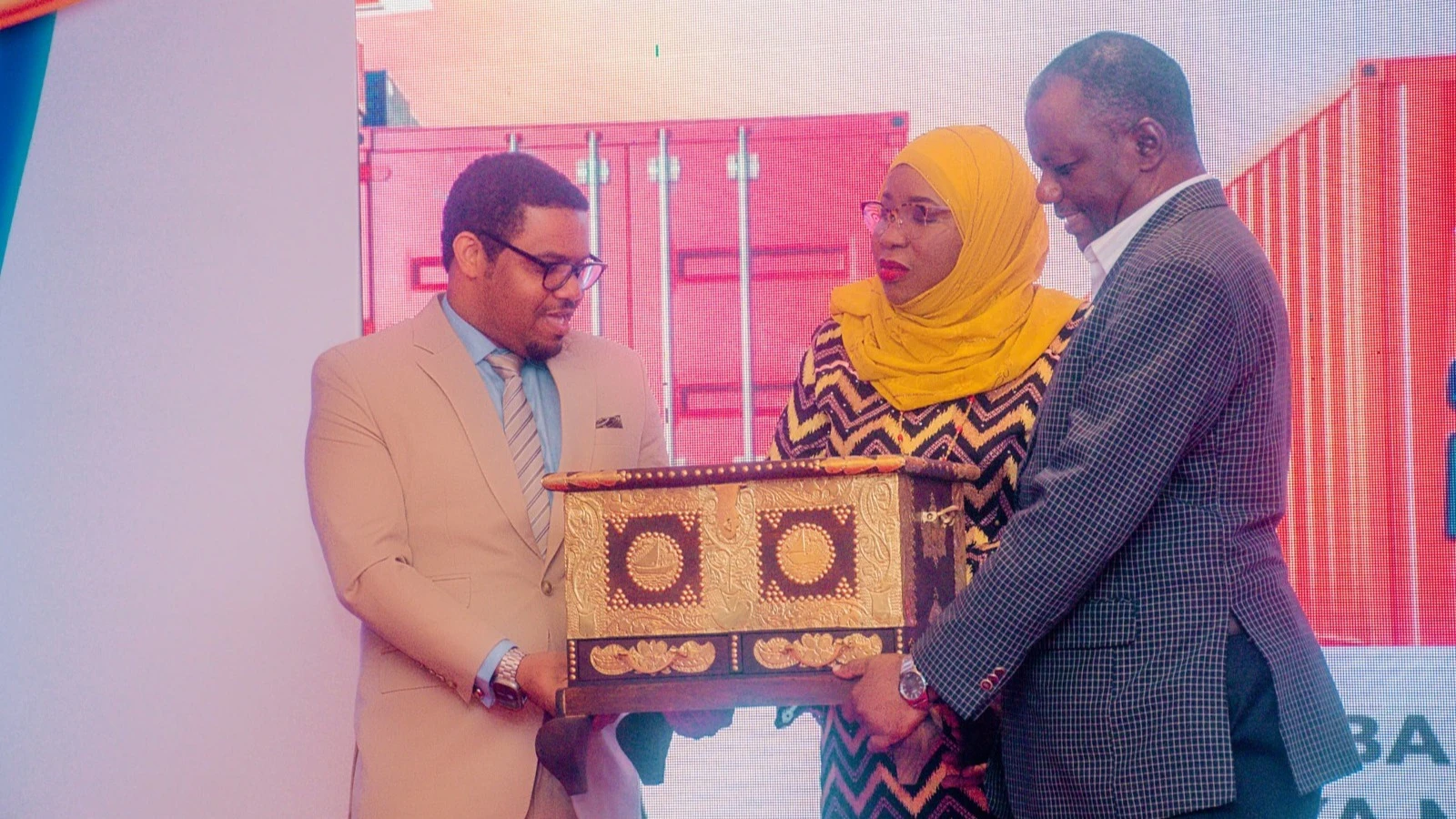

Khadija Said, TIRA's Deputy Commissioner made the call here yesterday when speaking at the function whereby the People's Bank of Zanzibar (PBZ) launched a bancassurance service as part of its efforts to enhance its services and increase the inclusion of more communities in the formal financial system through insurance services.

The bank’s move aims to support the government's efforts through the ten-year Financial Strategy Plan (2020-2030), which aims to ensure that by 2030, 80 percent of Tanzanians have a sufficient understanding of insurance services, with 50 percent using insurance services.

The function was attended by various stakeholders, including government officials, representatives of various insurance organizations, and customers.

Khadija asked the financial institutions to work closely with stakeholders to ensure that insurance services trickle down to the people so that they enjoy the untapped benefits in the sector.

She said that insurance provides many economic opportunities through the assurance of the security of citizens' assets, particularly those in peripheral areas.

The TIRA official praised the PBZ for the significant step stating that the service will help accelerate the delivery of insurance services in the isles as well as nationwide.

"This initiative is very important to the government as it supports the implementation of the ten-year Financial Strategy Plan (2020-2030), which aims to ensure that by 2030, 80 percent of Tanzanians have sufficient understanding of insurance services, with 50 percent using insurance services," she emphasized,

Khadija urged the bank to continue providing more education to citizens about the importance of insurance services through the bank.

Arafat Haji, PBZ managing director stated that the introduction of the service, which has all the necessary approvals from TIRA and the Bank of Tanzania (BOT), is part of the bank's strategy to continuously improve its services, to provide all services in one place (One Stop Shop).

"This product will be provided through all PBZ branches located in various areas in the country, in collaboration with various insurance companies, as authorized by TIRA. Through this step, PBZ is now ready to enable our customers to access insurance services and other financial services, such as obtaining loans for insurance premium financing, at a competitive level," he explained.

He mentioned the insurance services provided through the product, including Life Insurance, Motor Insurance, Engineering Insurance, Fire Insurance, Liability/Third Party Liability Insurance, Burglary Insurance, and Health Insurance.

"Other services include Fidelity Guarantee Insurance, Money Insurance, Marine Insurance, Bond Insurance and Counter Guarantees, and Asset All Risk Insurance," he specified.

Eddie Mhina, the bank's director of business outlined the insurance companies involved in this program as Zanzibar Insurance Corporation (ZIC), National Insurance Corporation (NIC), Alliance Life, Jubilee Insurance, Strategis Insurance, and Metro Life Assurance.

"The launch of this program comes at a time when PBZ is continuously excelling in our digital services, and thus being recognized as one of the financial institutions effectively implementing the vision of the Bank of Tanzania (BoT) in achieving an inclusive digital economy and transitioning towards a less cash-dependent economy," Mhina added.

According to Mhina, the bank's goal is to eliminate inconvenience for customers by adding several value additions to the insurance service, including easy access to reporting claims, convenience in registering new insurance policies where customers will receive digital notifications for the expiry of their policies, and receiving close support in renewing insurance policies.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED