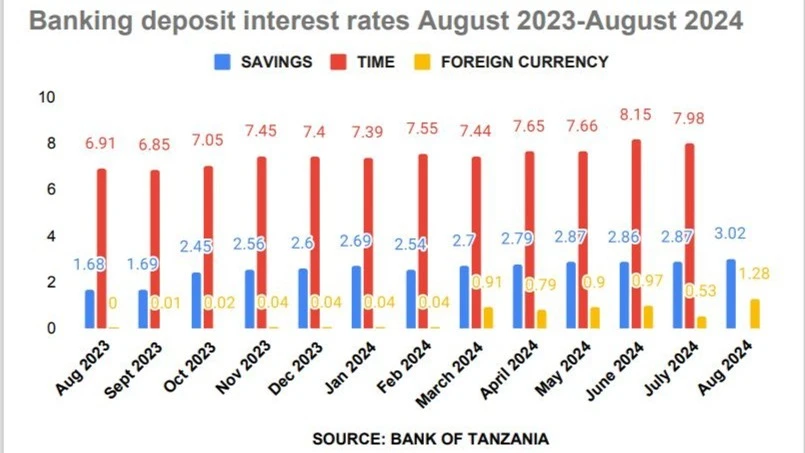

Banks raise deposits rates in 12 months

Depositors in banking industries are continuing to enjoy increased yields from their deposited funds, following the increase of both savings and negotiated deposit interest rates.

The banks and Bank of Tanzania (BoT) calculations data show the increase of savings and negotiated deposit rates over the last 12 months, as part of lenders incentives to mobilise funds to finance increased economic activities as well as promoting saving culture among Tanzanians.

Banks' foreign currency deposits also maintained an upward trend since January 2024, driven by high returns favouring holding and transacting in foreign currency.

However, BoT says this trend is expected to reverse following the ongoing policy interventions, including measures taken to reduce domestic dollar transactions in the economy and increase foreign currency liquidity highlighted in the 2024/25 government budget.

Data show the local currency savings deposit rate increased to 3.02 percent in August this year from 1.68 percent in August last year, while overall time deposit rate went up to 8.15 percent from 6.85 percent respectively.

Twelve months deposit rate jumped to 8.91 percent in August this year, from 8.08 percent in August last year and negotiated deposit rate slightly increased to 10.12 percent from 9.29 percent respectively.

The BoT report shows 24-months deposit rate jumped to 9.87 percent in August this year from 8.74 percent respectively.

In a meantime, savings deposit rate for foreign currency reached 1.28 percent in August this year from 0.04 percent in August last year, while overall time deposit rate slightly declined to 3.73 percent from 3.75 percent.

The report shows the foreign currency’s deposit rates for 2-month and 6-month also increased, while those of one month, three months and one year slightly declined.

BoT says improved performance of economic activities, banks’ deposit mobilization measures and enhanced use of agent banking as well as digital banking platforms continued to account for the growth in customer deposits.

Bankers say the increased deposit rates resulted from banks initiatives to mobilise funds to cater for increased demands for credits from different sectors of the economy.

“As customer deposits account for the largest share of source of funds and assets in banking industry, depositors need to be given incentives in a time when there is a growing demand for loans,” said a banker based in Dar es Salaam.

Reports show that private sector credits have continued to register robust growth, at 17.6 percent in July, a slight increase from 17.2 recorded in June 2024, but below the 20.8 percent growth rate recorded in the same period of 2023.

The recorded growth aligns with the private sector's demand for financing to support economic and investment activities.

Credit to agricultural activities continued to exhibit the highest growth rate, at 44.6 percent, driven by supportive government policies.

Personal loans, predominantly directed towards small and medium enterprises (SMEs), 5 represented the largest portion of private sector credit at 36.7 percent.

Other activities that accounted for a relatively large share of credit included trade, at 13 percent and agriculture at 11.8 percent.

The BoT’s Monetary Policy Report for July said growth in shilling denominated loans remained stable at an average of 22 percent, relatively similar to the previous quarter.

“Liquidity in banks was adequate and enough for loan provision, with the ratio of liquid assets to demand liabilities, as well as to total assets hovering above the regulatory requirements,” the report said.

In contrast, foreign currency-denominated loans slowed to 1.7 percent from 2.8 percent during the quarter ending March 2024, reflecting the decline in post import loans denominated in the foreign currency relative to the corresponding quarter of 2023.

“Credit to the private sector is expected to remain strong, attributable to the recovery of economic activities coupled with an improving business environment and supportive policies,” the report noted.

The continued demand for loans reflects a broader economic expansion, with businesses and personal borrowers’ alike seeking credit to fund operations and investments.

BoT says the banking sector remained well-capitalized and liquid, which encouraged further lending.

Interest rates on loans have decreased, while deposit rates have slightly increased, leading to a narrower interest rate spread, a sign of improved market efficiency.

As of September 2024, lending interest rates in Tanzania show a slight easing trend. The overall lending rate stands at approximately 15.42 percent, having decreased marginally from earlier months.

Short-term lending rates (for loans up to one year) are around 15.93 percent, while negotiated lending rates, where borrowers can discuss terms directly with lenders, hover near 13.95 percent.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED