African tech fundraising declines by 57pc

The downward trend in fundraising by African startups continues, though sectors like transportation, logistics, and fintech remain strong, with the "Big Four" maintaining their dominance on the continent.

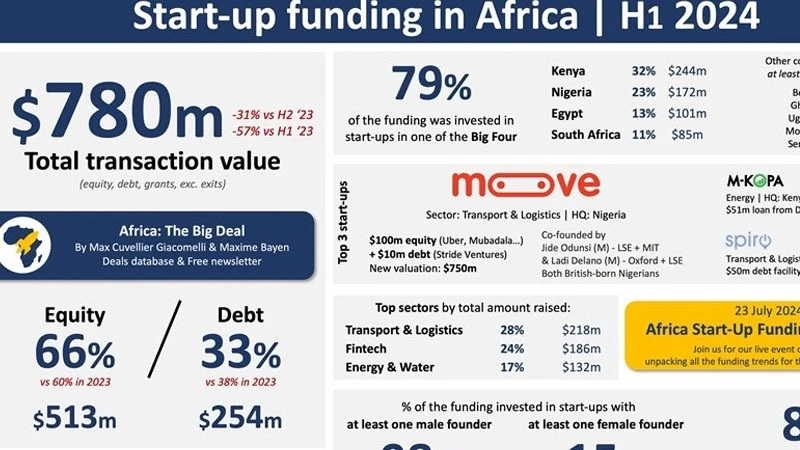

Data released on July 4, by the specialized platform thebigdeal.substack.com reveals that approximately $780 million flowed into African startups in the first half of 2024, marking a 57 percent drop compared to the same period in 2023.

The first quarter saw the highest activity with $466 million raised, followed by $314 million in the second quarter.

Of the $780 million raised, $513 million came from equity investments, while $254 million was raised through debt financing. The remaining amount consisted of grants and donations.

Geographically, the "Big Four" countries—Kenya, Egypt, Nigeria, and South Africa—captured 79% of the total funding. This marks a decline from the first half of 2023 when these countries accounted for 92% of total funds raised on the continent.

In detail, Kenya alone attracted one-third of all financing raised by June 2024, totaling $244 million, followed by Nigeria ($172 million), Egypt ($101 million), and South Africa ($85 million).

Other economies such as Benin ($50 million raised), Ghana ($29 million), Uganda ($19 million), Morocco ($14 million), and Senegal ($11 million) showed promising results during the semester.

Key sectors mirrored those of the first quarter: transportation, logistics, fintech, energy, and water. Notable fundraising efforts included $110 million raised by mobility fintech Moove in March, $51 million in loans secured by M-Kopa in May, and $50 million raised by mobility startup Spiro, also in May 2024.

Between 2020 and 2021, the number of tech start-ups in Africa tripled to around 5,200 companies. Just under half of these are fintechs, which are making it their business to disrupt and augment traditional financial services.

McKinsey analysis shows that African fintechs have already made significant inroads into the market, with estimated revenues of around $4 billion to $6 billion in 2020 and average penetration levels of between 3 and 5 percent (excluding South Africa).2 These figures are in line with global market leaders.

Despite a slow-down in funding in line with global trends, we expect significant growth and value creation to lie ahead for the fintech industry in Africa.

Cash is still used in around 90 percent of transactions in Africa, which means that fintech revenues have huge potential to grow.

If the sector overall can reach similar levels of penetration to those seen in Kenya, a country with one of the highest levels of fintech penetration in the world, we estimate that African fintech revenues could reach eight times their current value by 2025.

McKinsey analysis estimates that Africa’s financial-services market could grow at about 10 percent per annum, reaching about $230 billion in revenues by 2025 ($150 billion excluding South Africa, which is the largest and most mature market on the continent).

Nimble fintech players have wasted no time carving out a share of this expanding market.

As the fastest-growing start-up industry in Africa, the success of fintech companies is being fueled by several trends, including increasing smartphone ownership, declining internet costs, and expanded network coverage, as well as a young, fast-growing, and rapidly urbanizing population.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED